Glencore’s Horne smelter talks: emissions, capex and closure risk for mine planners

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

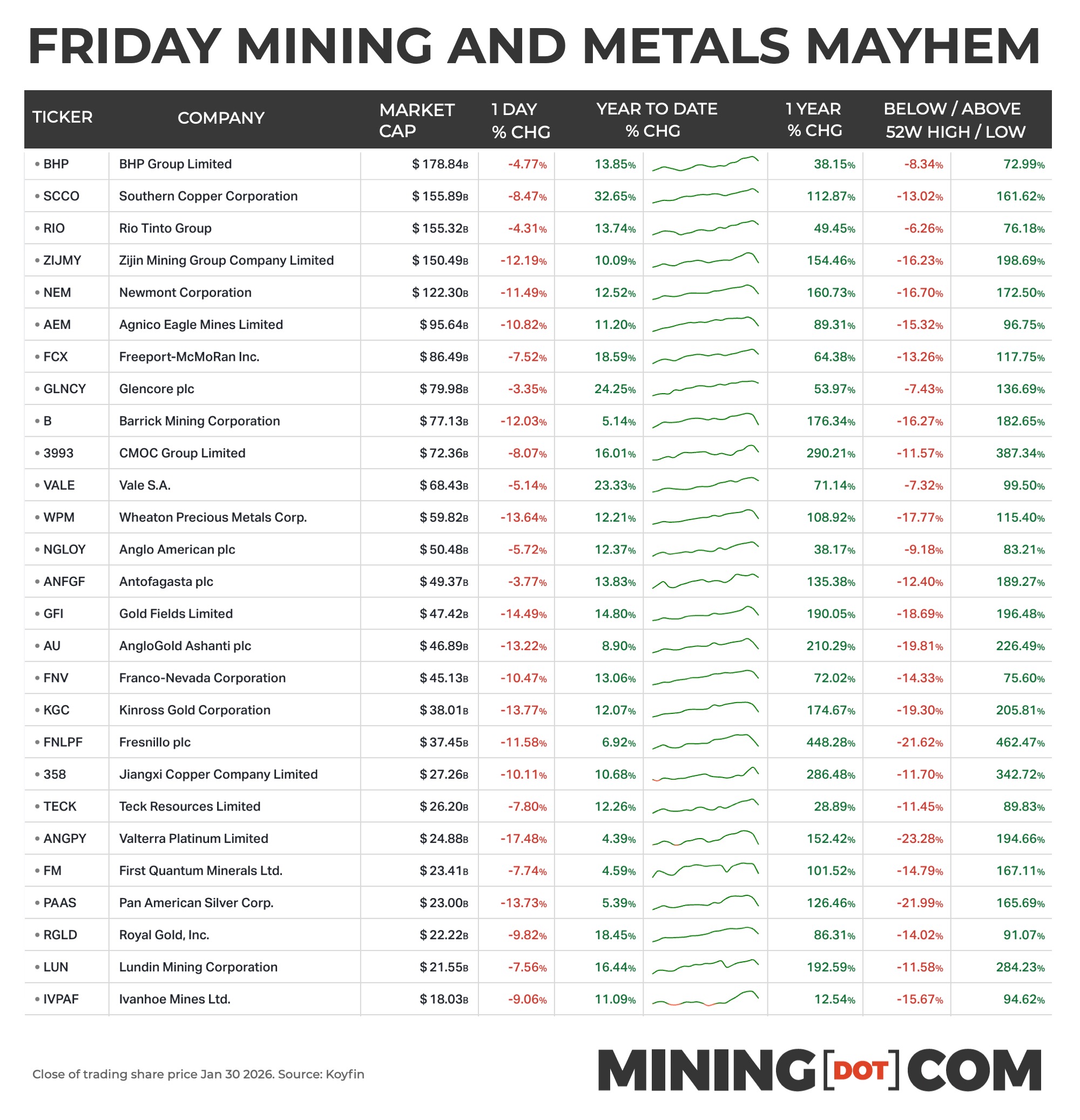

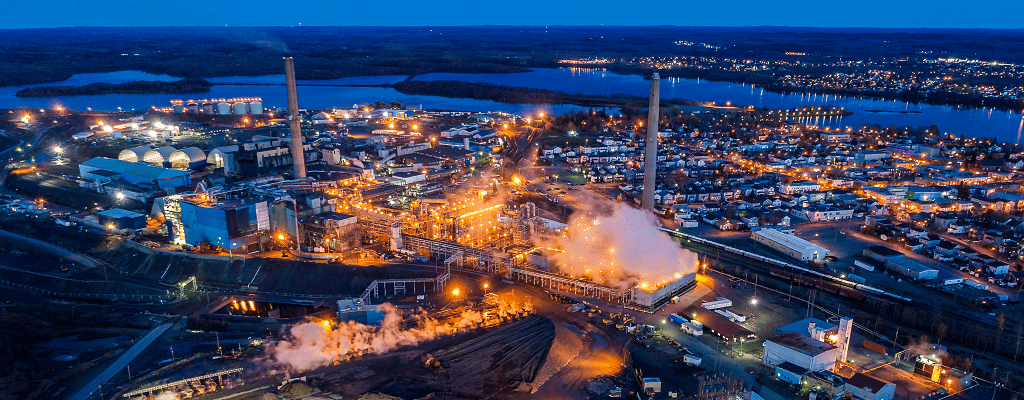

Glencore remains deadlocked with Quebec over the future of its nearly 100-year-old Horne copper smelter in Rouyn-Noranda, where arsenic emissions must be cut from current levels to 45 ng/m³ by March and 15 ng/m³ from 2027—still five times the provincial standard. The company is weighing a US$200 million modernisation to meet the 15 ng/m³ target but is demanding an 18‑month transition period and guarantees against tighter future limits before committing. Closure would also threaten the Canadian Copper Refinery in Montreal, which relies on Horne’s 210,000 t/y copper and precious metals output, and comes amid an authorised class action over historical emissions.

Technical Brief

- The company is tying any investment decision to the duration and terms of the next ministerial authorisation.

- Horne and Montreal’s Canadian Copper Refinery together constitute Canada’s only fully integrated copper smelting–refining chain.

- Horne currently processes copper concentrates and outputs about 210,000 tonnes per year of copper plus precious metals.

- Two Quebec unions have publicly pressed Premier François Legault to conclude an agreement before his planned resignation.

- For other smelting operations, the case underlines how regulatory predictability directly conditions large‑scale emissions‑control CAPEX decisions.

Our Take

Glencore’s need to justify roughly $200–300 million of emissions upgrades at the Horne copper smelter comes as our recent coverage shows its copper output under pressure from weaker grades elsewhere, which may limit appetite for non‑essential capex but also raises the strategic value of keeping North American refining capacity online.

The arsenic limits being negotiated in Quebec are materially tighter than legacy norms for older smelters, signalling that other ageing copper and precious‑metals facilities in Canada could face similar retrofit-or-closure choices as provincial regulators move closer to health-based standards.

With copper prices recently highlighted in our database as underpinning one of the strongest earnings outlooks for diversified miners, Glencore has more pricing headroom than in past downturns to absorb a phased 18‑month transition at Horne, which may strengthen Quebec’s hand in insisting on the 2027 arsenic target rather than long deferrals.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.