Copper price pulls out of nosedive: risk signals for mine planners and engineers

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

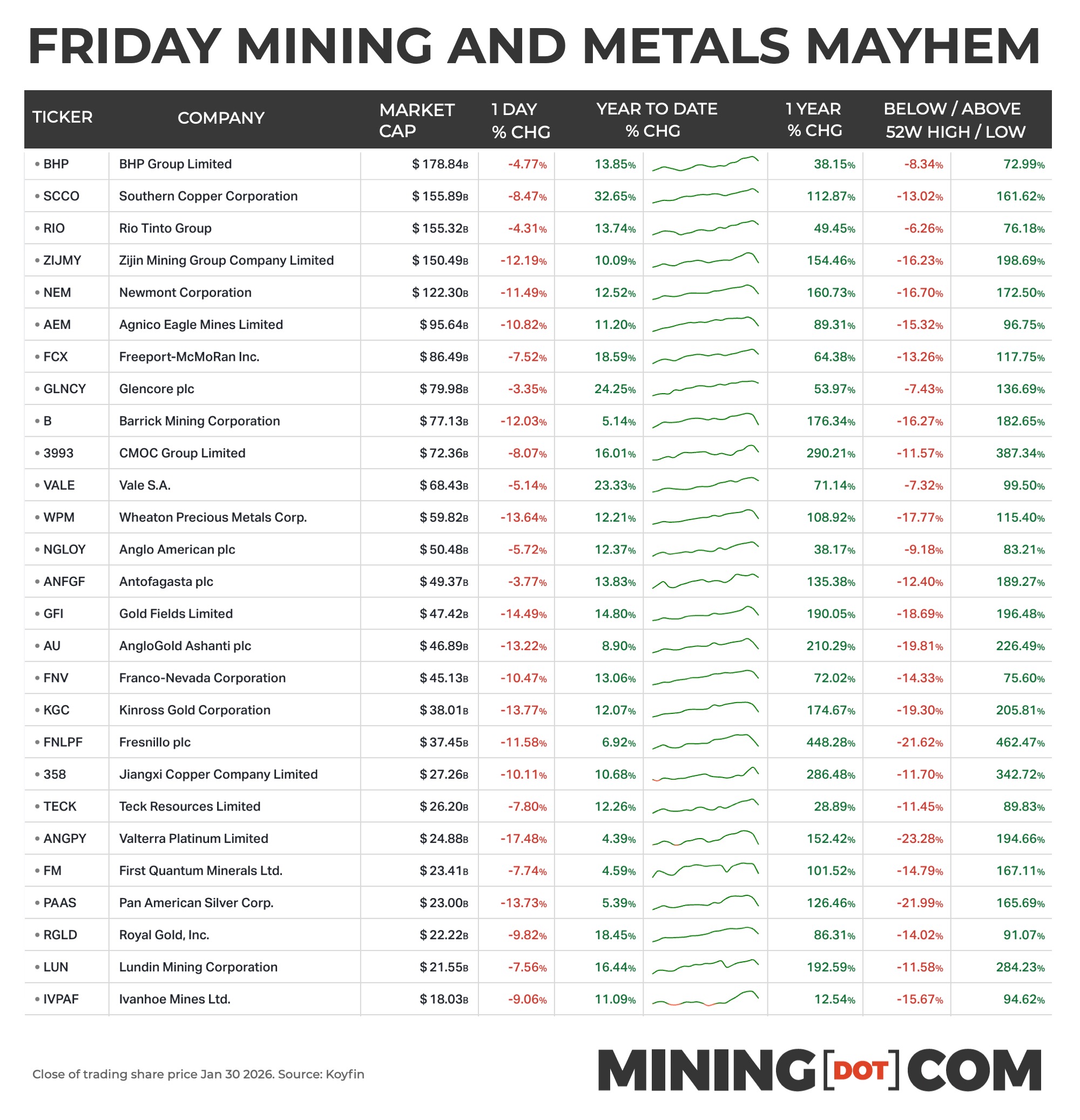

Precious metals and copper prices plunged on Friday after the US Fed chair nomination triggered profit-taking, with April gold futures crashing 11.4% to $4,745/oz and silver suffering a record 35.9% drop to $78.53/oz, while March copper briefly fell 9.5% to $5.76/lb before closing 4.5% lower at $5.92/lb. The sell-off wiped billions from miners: Newmont fell 11.5% to a $122bn valuation, Barrick 19%, and silver-focused Pan American Silver 13.7% to $23bn. Diversified and copper majors were hit less severely, with BHP down 4.8%, Rio Tinto 4.3%, Glencore 3.4% and Southern Copper 8.5%, yet most leading miners remain strongly positive year-on-year.

Technical Brief

- Intraday gold futures fell from an intraday low of $4,700/oz before closing at $4,745/oz.

- Silver swung to $74/oz intraday, then closed at $78.53/oz, both record-scale daily moves.

- Palladium and platinum futures closed at $1,700/oz and $2,178/oz, down 15% and 17% respectively.

- Copper’s intraday low of $5.76/lb rebounded to $5.92/lb, versus Thursday’s $6.58/lb all‑time high.

- Newmont and Barrick traded 19m and 31m shares respectively, indicating very high liquidity stress.

- Agnico Eagle’s valuation dropped below $100bn to $95.6bn; Anglogold and Gold Fields ended near $47bn each.

Our Take

The sharp one-day drawdowns in gold majors such as Newmont and Franco-Nevada contrast with our later coverage where Franco-Nevada co-founder Pierre Lassonde publicly backs a long-term US$4,000/oz gold price, underscoring how sentiment-driven selloffs can diverge markedly from the long-run price expectations of sector insiders.

Copper producers hit here, including BHP, Jiangxi Copper and Antofagasta, reappear across our database in 2025 deal and governance stories (e.g. Jiangxi’s bid for SolGold and Antofagasta’s ICMM chairmanship), suggesting that balance sheet resilience and strategic positioning during such price shocks can directly shape their ability to pursue M&A and industry leadership roles later on.

The coltan mine collapse in east Congo, at a site producing about 15% of global coltan, highlights a supply-risk profile that is largely absent from the 419 copper- and gold-focused pieces in our database, signalling that project developers in battery and critical minerals may face more acute ESG and security-of-supply scrutiny than traditional base and precious metals operators.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.