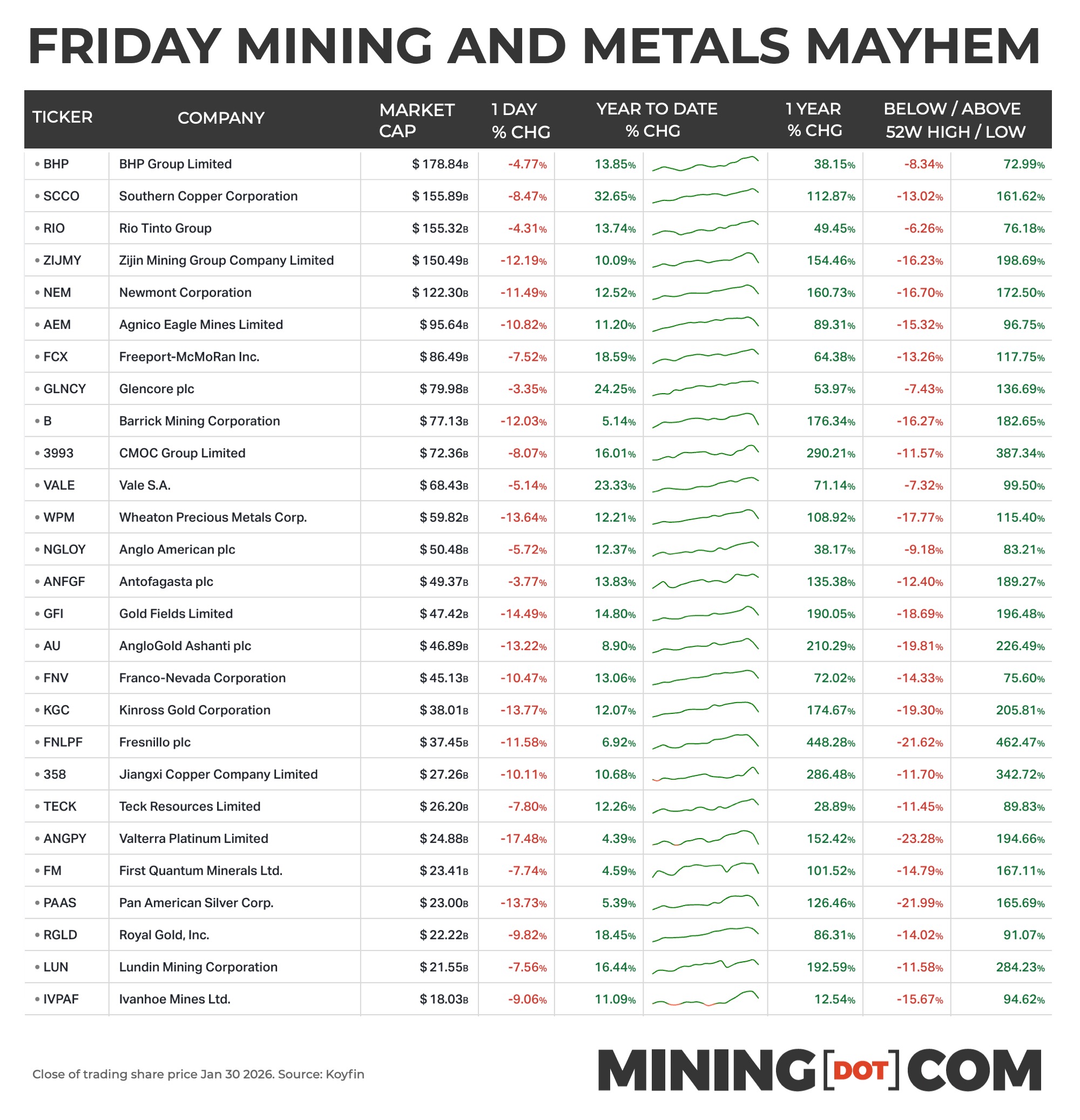

MAX Power Mining’s new natural hydrogen target: subsurface insights for project teams

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

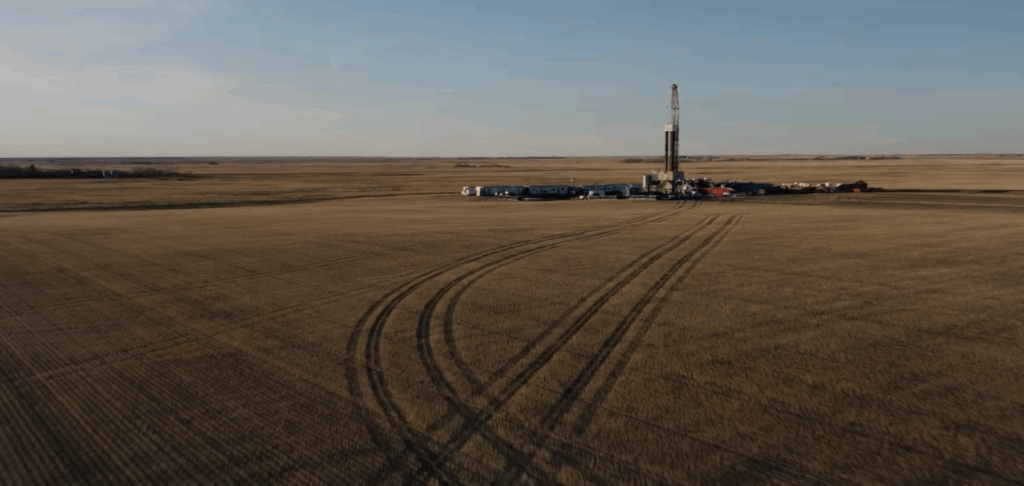

MAX Power Mining has defined a new natural hydrogen drilling target at the Bracken prospect on the Saskatchewan–Montana border, complementing its confirmed Lawson discovery on the 475 km-long Genesis Trend. The Bracken well, planned to spud in February pending licensing, sits within the 75 km-wide Grasslands project and was sited using 34.3 line-km of proprietary 2D seismic integrated with legacy seismic to map basement architecture, structural pathways and migration corridors. MAX Power aims to use Bracken as a calibration point to test basin-scale continuity and repeatable, scalable natural hydrogen systems that may also host helium.

Technical Brief

- Lawson natural hydrogen discovery is undergoing analytical testing, resource modelling and formal resource estimation in parallel.

- MAX Power is targeting February spud for Bracken, contingent on completion of Saskatchewan licensing.

- Grasslands project covers a 75 km-wide permitted corridor, giving room for multiple step-out wells.

- Bracken is described as a second “play concept”, distinct from the Lawson Genesis Trend system.

- Integrated workflow combined 34.3 line‑km of new proprietary 2D seismic with legacy 2D seismic coverage.

- Interpretation focused on basement architecture, structural/stratigraphic pathways and migration corridors for hydrogen and “clean gas”.

- Grasslands, like Genesis, is considered prospective for co‑occurring helium with natural hydrogen accumulations.

- CEO emphasises “months to molecules” timelines, contrasting natural hydrogen commercialisation speed with conventional mineral/metal projects.

Our Take

Natural hydrogen appears only sporadically in our 820 Mining stories, so MAX Power Mining’s Lawson and Grasslands work in Saskatchewan positions Canada alongside a small group of early-mover jurisdictions experimenting with dedicated H2 exploration rather than incidental gas finds.

The 475 km Genesis Trend and 75 km-wide Grasslands project imply a basin-scale play concept; if even modest accumulations are confirmed, this could favour portfolio-style exploration strategies more akin to helium and conventional gas than to typical hard‑rock mining projects in Saskatchewan.

With helium also listed as a target commodity, MAX Power’s Saskatchewan focus mirrors other helium–hydrogen dual plays in our database, suggesting that operators see shared subsurface risk and infrastructure synergies that can improve exploration economics for both gases.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.