USGS China chokehold warning: supply risk and project signals for US miners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

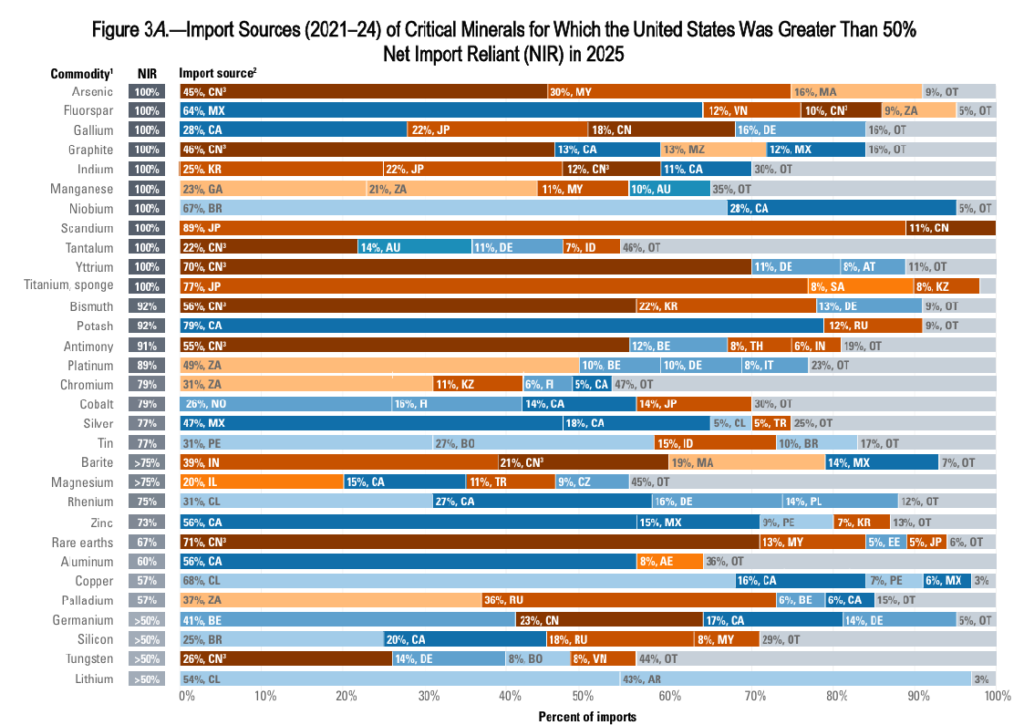

US mineral supply chains became more exposed in 2025, with the USGS reporting 100% import reliance for 16 of 90 tracked non-fuel commodities and more than 50% reliance for 54 minerals, up from 15 and 46 respectively in 2024. The US is totally dependent on imports of arsenic, natural graphite, manganese, niobium, tantalum, titanium sponge and 10 other minerals, with China supplying nearly half of arsenic and graphite, 55% of antimony and 70% of rare earths. In response, the Trump administration has proposed a $12 billion critical minerals stockpile and a JD Vance-led allied trade bloc, while industry warns US mine permitting still averages 29 years.

Technical Brief

- USGS 2026 Mineral Commodities Summary covers 90 non-fuel mineral commodities in its dependency analysis.

- Sixteen fully import-dependent commodities include arsenic, asbestos, cesium, fluorspar, gallium, natural graphite and indium.

- Additional fully import-reliant minerals are manganese, natural mica, niobium (columbium), rubidium, scandium, strontium, tantalum, titanium sponge and yttrium.

- Only three of those 16 (asbestos, mica, strontium) are absent from the formal USGS critical minerals list.

- A further 20 critical minerals show net import reliance above 50%, down from 28 the previous year.

- China supplies about 55% of US antimony imports and roughly 70% of rare earth elements.

- Canada is the leading import source for US aluminium, gallium, potash and zinc supply chains.

- Chile and Mexico dominate US import sourcing for newly listed criticals copper and silver, respectively.

- National Mining Association cites an average 29-year timeline from discovery to production for US mines, constraining rapid reshoring.

Our Take

The planned $12 billion US critical minerals stockpile flagged in the separate “Project Vault” policy piece in our coverage directly echoes the USGS concern here, signalling that materials like gallium, graphite and rare earths are being treated as strategic assets rather than just industrial inputs.

In our database, USGS appears not only as a data provider in this report but also as a reference point in silver and copper market analysis, which suggests its critical minerals tracking is increasingly being used by investors as much as by policymakers.

The 29‑year average mine development time in the US means that, for many of the 20–28 critical minerals with >50% net import reliance, near‑term supply security will likely depend more on stockpiling and offtake from allies such as Canada, Chile and Mexico than on new domestic greenfield projects.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.