US critical mineral resilience in 2026: processing-first shift for project teams

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

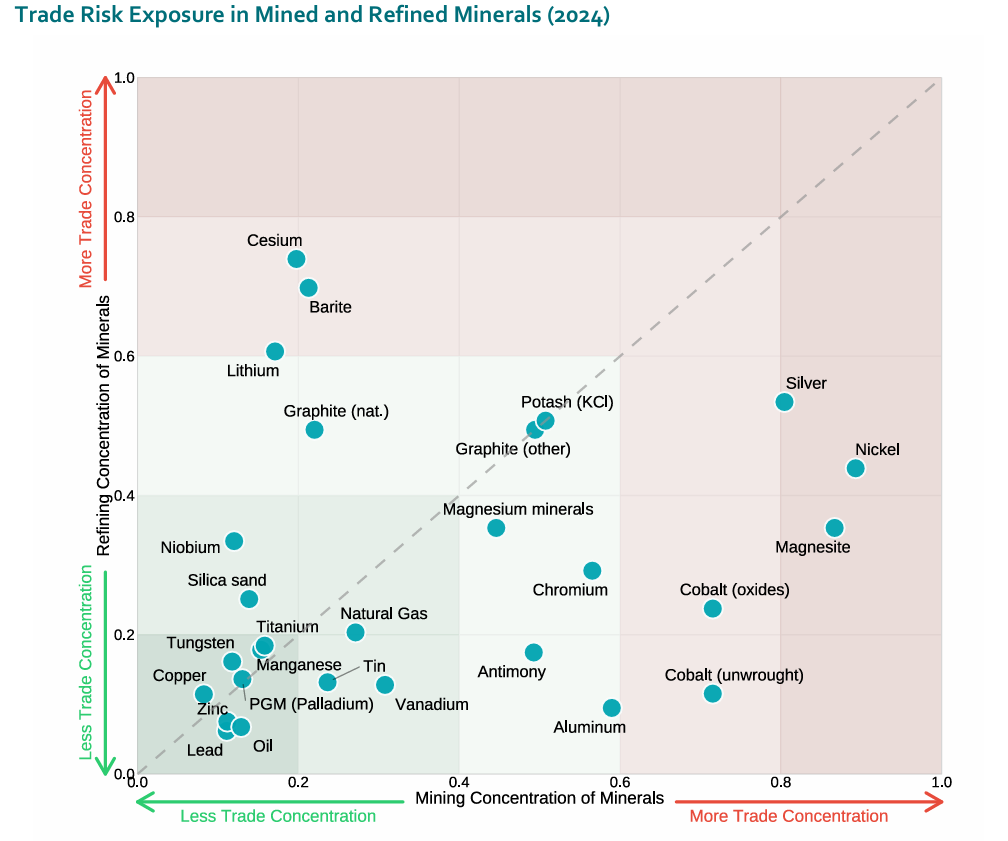

US federal critical minerals policy in 2026 is set to move beyond rare earths to high‑risk inputs such as antimony and tungsten, where the US currently relies heavily on China, Tajikistan and Russia for supply into defence alloys, munitions and flame‑retardant applications. Washington is expected to prioritise domestic processing capacity over new mines, backing alternatives to traditional smelting and refining that cut emissions and withstand high US power prices. Intensifying competition for electricity from AI data centres will put aluminium, copper, magnesium and titanium processors under pressure, favouring technologies that materially lower energy use and total production costs.

Technical Brief

- Washington is explicitly targeting antimony and tungsten as “high‑risk” minerals alongside existing rare earth priorities.

- US antimony sourcing is currently dominated by imports from China, Tajikistan and Russia, creating defence‑sector exposure.

- Policy tools will favour processing routes that avoid traditional pyrometallurgical smelting and legacy wet‑chemistry refining flowsheets.

- Emissions acceptability to nearby communities is becoming a hard design constraint for new processing facilities.

- Cost structures must remain competitive against low‑cost overseas processors even under elevated US power tariffs.

- Aluminium, copper, magnesium and titanium processors are singled out as especially vulnerable to rising electricity competition.

- Federal industrial‑innovation programmes are being positioned as capital sources for novel, lower‑energy metals‑processing technologies.

Our Take

Among the 57 Policy stories in our coverage, only a subset deal with multi-commodity exposure like this one; the combination of copper, rare earth elements, antimony and magnesium suggests that US ‘resilience’ planning is now being framed around whole supply chains rather than single-commodity bottlenecks.

The sharp month‑on‑month drop in China’s rare earth magnet exports to the United States, even at sub‑1,000 t levels, implies that any 2026 policy reset will need to prioritise magnet manufacturing capacity as much as upstream rare earth mining projects now appearing in our 815 tag‑matched ‘Projects’ and ‘Sustainability’ pieces.

With the article flagging near‑total dependence on China, Tajikistan and Russia for antimony, operators looking at US‑based antimony, tungsten or specialty minerals projects are likely to find a more receptive policy environment by 2026 than copper projects alone, which already feature heavily in the 125 keyword‑matched items in our database.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

QCDB-io

Comprehensive quality control database for manufacturing, tunnelling, and civil construction with UCS testing, PSD analysis, and grout mix design management.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.