IEF critical minerals trade warning: supply risk lens for project teams

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

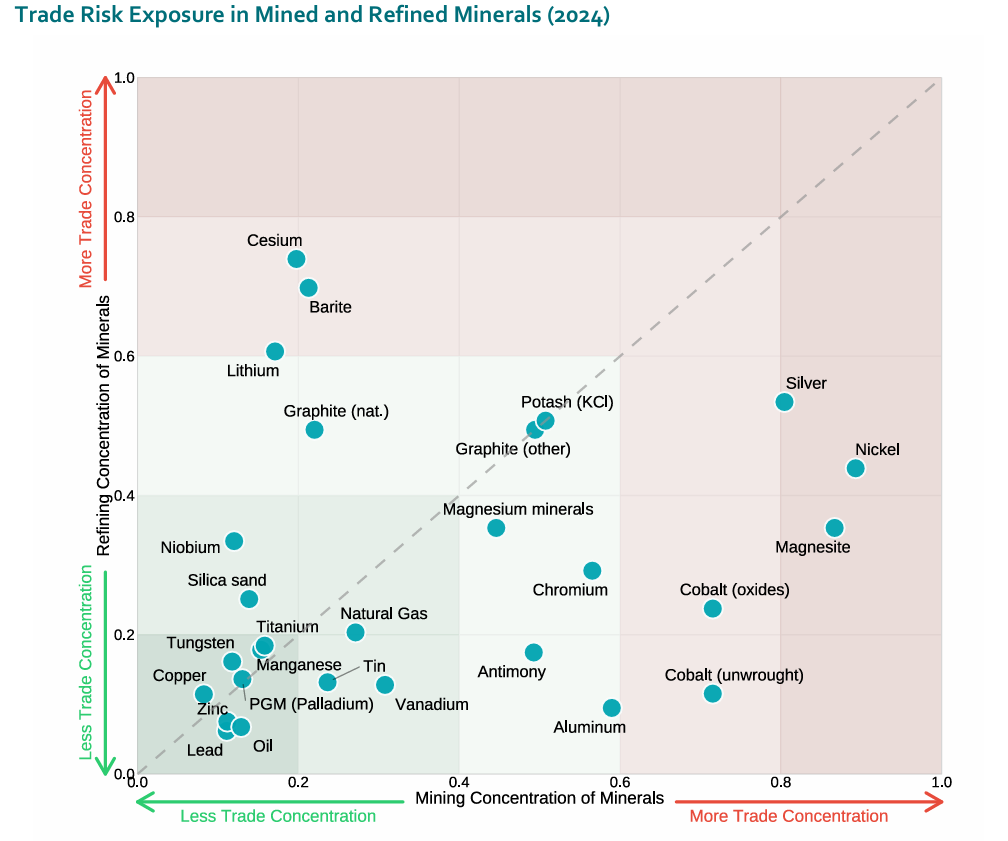

More than 60% of global demand for critical minerals is now met via international trade, with the IEF warning that copper and nickel could face material shortfalls by the mid-2030s as total demand for copper, nickel, cobalt, lithium and rare earths climbs from 28 Mt in 2021 to nearly 41 Mt by 2040. EV copper use alone is forecast to jump from 200,000 t in 2020 to 3.4 Mt by 2035, while Indonesia supplies over half of nickel, the DRC about 70% of cobalt, and China over 90% of rare earth refining. More than 600 policies now target critical mineral supply chains, with the US, Canada and Australia incentivising exploration, refining and recycling, and Indonesia, Chile and Peru pushing in-country value addition and export controls.

Technical Brief

- IEF’s A Critical Minerals Enabled Energy Future report frames supply risk via quantified 2040 demand scenarios.

- Clean energy uses push copper demand within this basket to more than 12 Mt by 2040.

- Lithium and nickel show >10× demand growth, driven primarily by battery and grid‑storage manufacturing build‑out.

- EVs are assumed to require roughly four times more copper than internal‑combustion vehicles in IEF modelling.

- AI, data centres and semiconductor fabrication are identified as competing end‑uses for the same mineral streams.

- Since 2020, critical‑minerals policies have nearly doubled the cumulative total issued in the previous 20 years.

- For project developers, policy‑driven export controls and domestic processing mandates materially affect offtake, financing and plant siting.

Our Take

With more than 600 critical-mineral policies now on the books and demand for copper, nickel and lithium rising sharply through 2040, permitting and ESG standards in major producers such as Chile, Australia and Canada are likely to become as decisive for supply security as geology or capex.

Projected copper shortfalls by the mid‑2030s, combined with EV copper use growing at an estimated 14% a year to 2035, suggest higher-cost or lower-grade copper projects in regions like Latin America and Africa could be pulled into the money earlier than their feasibility studies assumed.

China’s control of over 90% of rare earth refining and the Democratic Republic of the Congo’s dominance in cobalt output mean that OECD‑country policies flagged in this piece will probably lean heavily on midstream investments (refining, recycling, alloying) rather than trying to replicate upstream concentration patterns.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

QCDB-io

Comprehensive quality control database for manufacturing, tunnelling, and civil construction with UCS testing, PSD analysis, and grout mix design management.