Rio Tinto–Glencore coal option: portfolio and project impacts for mine planners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

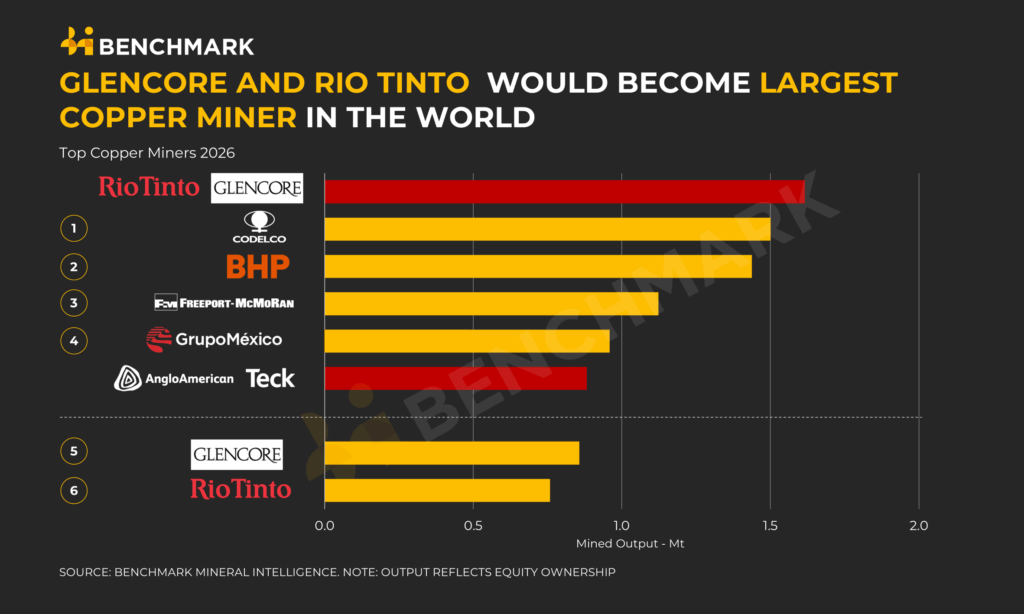

Rio Tinto is considering temporarily owning Glencore’s coal business, including the Ulan complex and Teck-acquired assets, to clear a key hurdle in buyout talks that could create a $207 billion mega-miner and the world’s largest listed mining company. One option under discussion is Rio acquiring all of Glencore, then later divesting coal while retaining the $1.4 billion‑EBIT first-half 2024 marketing division, which Goldman Sachs values at up to $4 billion by 2030. Analysts expect significant portfolio reshuffling, with copper the core rationale as combined 2026 copper output could exceed 1.6 million tonnes.

Technical Brief

- Rio exited coal in 2018, so any temporary coal ownership reverses an established portfolio constraint.

- Glencore’s coal portfolio includes the Ulan complex in New South Wales plus Teck’s former coal assets.

- Rio has an enterprise value of about A$200 billion ($134 billion), positioning it as the likely acquirer.

- Goldman Sachs assigns up to $4 billion 2030 value to Glencore’s marketing business, shaping deal economics.

Our Take

The potential Rio Tinto–Glencore tie-up follows Canada’s approval of the Anglo American–Teck Resources merger, which our coverage notes would control just under 5% of global copper supply, signalling regulators are currently willing to sign off on very large diversified miners so long as copper and critical minerals exposure is strengthened.

In our database of 539 Mining stories, Glencore and Rio Tinto appear frequently in copper- and coal-tagged items, and the projected structural copper deficit from 2026 highlighted in the December 2025 copper outlook piece suggests that any combined group would be under pressure to prioritise copper and rare earth growth over legacy coal even if it temporarily accepts coal exposure.

Benchmark Minerals’ estimate of 1.6 million tonnes combined output by 2026 for Rio and Glencore sits against a backdrop of other mega-mergers like Anglo–Teck, indicating that scale in bulk commodities and marketing (such as Glencore’s trading arm) is becoming a key strategic lever for negotiating offtake and capital access, particularly with buyers in China and Japan referenced in this article’s country set.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.