Orla Mining share slump after Fairfax exit: project and capex lens for engineers

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

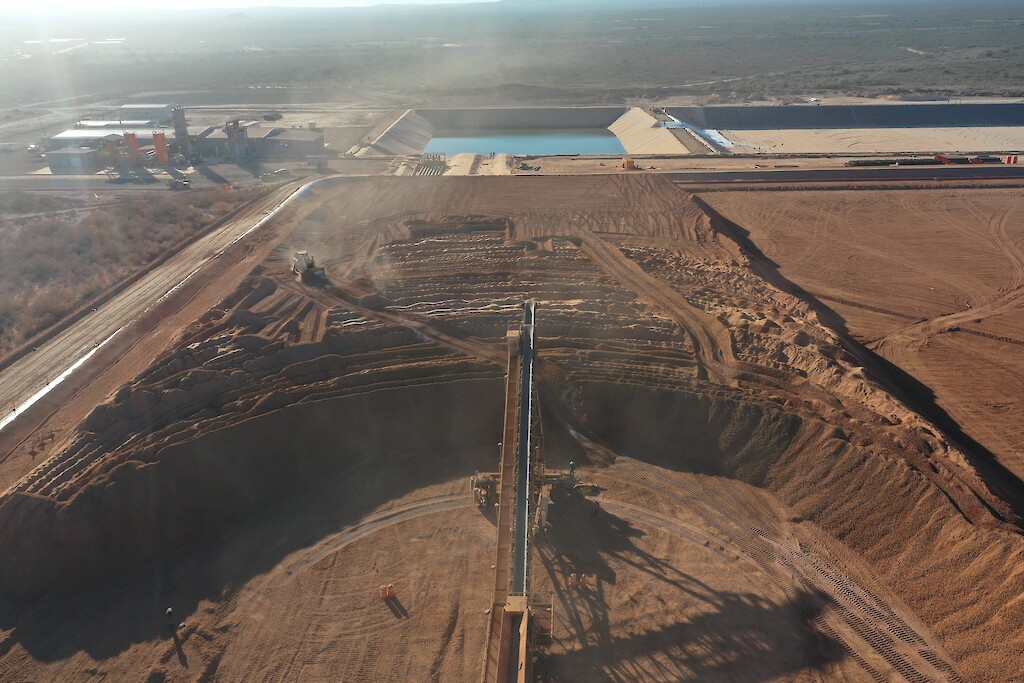

Orla Mining shares fell as much as 9.5% to C$17.30 on Friday after Fairfax Financial sold 25 million shares at C$17.6435, cutting its stake from 16.7% to 9.4% and raising about C$441.1 million. The Vancouver-based gold miner, now valued just under C$6 billion, has seen its stock more than double this year on record gold prices despite major shareholders exiting. Orla operates the Camino Rojo open pit and developing underground mine in central Mexico and the Musselwhite mine in Ontario, together forecast to produce 265,000–285,000 oz gold in 2025.

Technical Brief

- Fairfax disposed of 25 million Orla shares in a single block at C$17.6435 each.

- Proceeds from the Fairfax sale totalled approximately C$441.1 million in cash.

- Its holding dropped from about 56.8 million shares (16.7% non‑diluted) to 9.4%.

- The transaction was executed at a below‑market price, triggering immediate selling pressure in the stock.

- Intraday, Orla’s share price fell to C$17.30, the lowest level in nearly two weeks.

- By midday trading, the price had partially recovered to C$17.49, implying just under C$6 billion market cap.

- Newmont previously exited completely by selling 43 million Orla shares at C$10.14 in September.

- Orla’s producing assets now comprise Camino Rojo (open pit plus developing underground) in Mexico and Musselwhite in Ontario.

Our Take

With Orla Mining now near a C$6 billion market capitalisation and focused on gold in Mexico and North America, it sits at the larger end of the gold names in our recent coverage, which has otherwise skewed towards smaller Ontario-focused producers like McEwen Mining at Froome.

The back-to-back selldowns by Newmont and Fairfax in Orla, both at materially different share prices, suggest that larger strategic holders are rotating out even as generalist and institutional demand steps in at higher valuations, which can increase share price volatility around future project or M&A news tied to Camino Rojo or other North American gold assets.

Given that our database shows many of the 170 Mining stories and 385 Projects-tagged pieces are about early-stage gold and lithium development risk, Orla’s situation highlights a different issue for practitioners: secondary liquidity and block-trade overhang can become a key risk factor even for producing or near-producing gold companies in stable jurisdictions like Canada and Mexico.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Tunnelling

Specialised solutions for tunnelling projects including grout mix design, hydrogeological analysis, and quality control.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.