IEA coal demand record: system planning and decarbonisation notes for engineers

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

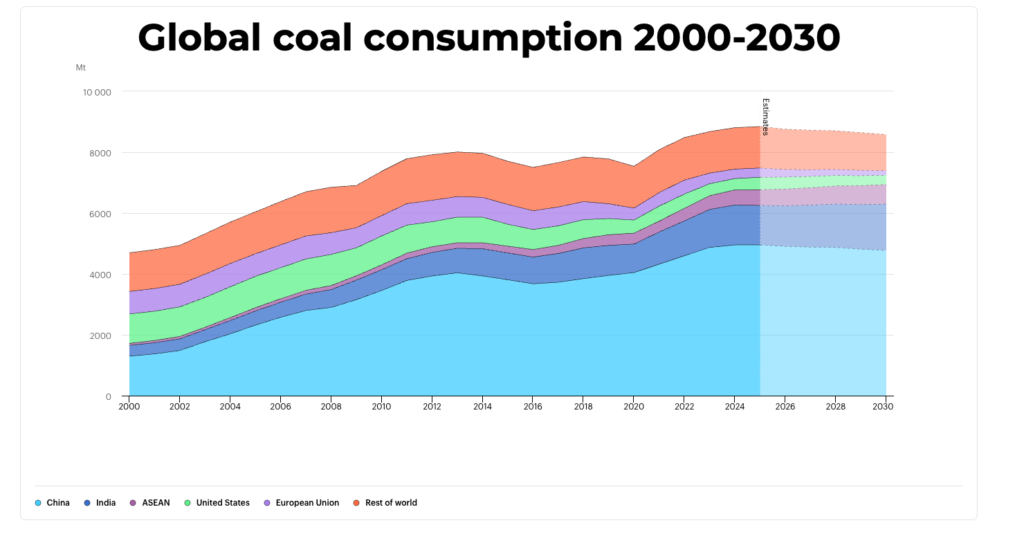

Global coal demand is forecast by the IEA to rise 0.5% in 2025 to a record 8.85 billion tonnes, with US coal use jumping 8% after 15 years of roughly 6% annual declines as higher gas prices, slower coal plant retirements and federal policy support lift output. Weak wind conditions in Europe are also sustaining coal burn, while surging electricity demand in China, India and other fast-growing economies keeps global consumption elevated. The IEA expects demand to plateau and then edge down only slowly through 2030, leaving long-term decarbonisation pathways under pressure.

Technical Brief

- IEA’s 2025 coal outlook pegs global demand at 8.85 billion tonnes, up 0.5% year-on-year.

- US coal consumption reverses ~15 years of ~6% annual decline with an 8% 2025 rebound.

- Higher US coal burn is explicitly linked to elevated gas prices and delayed coal plant retirements.

- Weak wind resource in Europe is identified as a direct driver of continued coal-fired generation.

- IEA concedes earlier 2023 call that coal demand had “likely peaked” was invalidated by 2024–2025 records.

- Surging electricity demand in China, India and other fast-growing economies is singled out as the main upside risk.

- IEA flags “significant uncertainties” in its five‑year coal forecast, implying high scenario spread for fuel planning.

- UNEP’s 2025 Emissions Gap Report projects ~2.3°C warming by 2100 even if current pledges are fully met.

Our Take

With projected global coal demand at 8.85 billion tonnes in 2025, the IEA numbers imply that any accelerated phase-out in Europe or North America would have to be offset by much steeper cuts in Asia to stay near the 2.3°C pathway flagged by the UN Emissions Gap Report.

An 8% uptick in US coal use after roughly 15 years of ~6% annual decline signals that gas and power-price volatility can still reverse decarbonisation gains at the margin, which project developers in coal and natural gas in North America will read as justification for keeping some legacy capacity warm rather than fully retired.

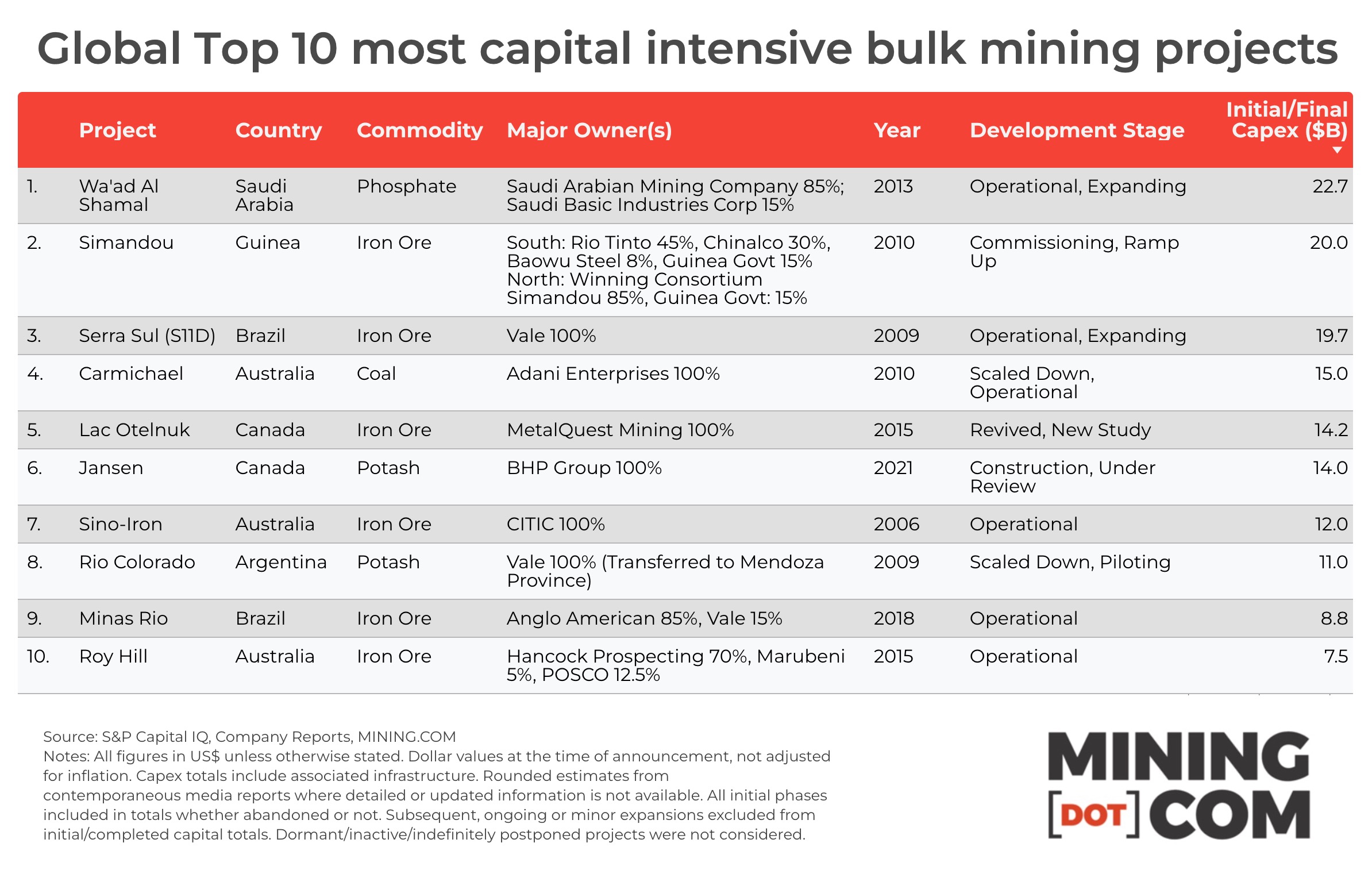

Among the 18 coal- and natural-gas-tagged pieces in our database, most recent coal coverage has focused on mine closures and ESG pressure, so this IEA-driven demand growth story stands out as a reminder that global system-level emissions are diverging from the project-by-project decarbonisation narrative in Europe and Australia.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.