MEGAMINES’ top 10 most capital intensive bulk mines: capex and risk notes for engineers

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

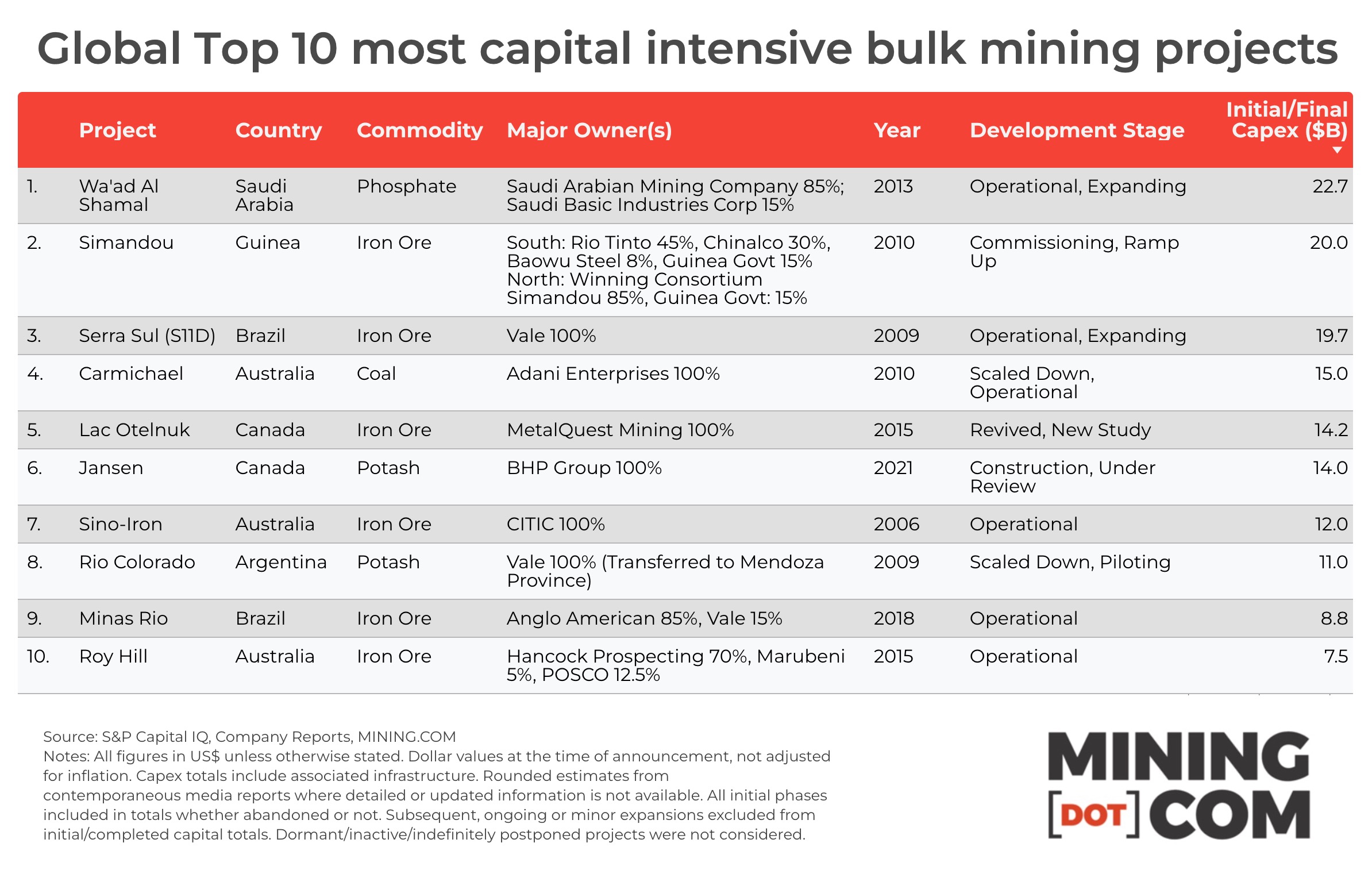

MEGAMINES ranks Saudi Arabia’s Wa’ad Al Shamal phosphate complex as the world’s costliest mining project, with total industrial-city investment of $22.7 billion and Ma’aden’s mine-and-refining CAPEX estimated at $15.5 billion, including an $8 billion original plant and a $7.7 billion Phosphate 3 expansion due by 2027. Guinea’s Simandou iron ore development follows with more than $20 billion in shared mine–rail–port spend, a 600 km trans-Guinean railway to a new deepwater port, and targeted output of 120 Mtpa of ~66% Fe ore by 2028. Brazil’s Serra Sul (S11D) at $19.5 billion plus a $2.8 billion brownfield expansion to 120 Mtpa, and Adani’s Carmichael coal project, originally scoped at 60 Mtpa with A$16.5–A$22 billion CAPEX but now operating at 10 Mtpa with a 200 km rail link, illustrate the scale, long timelines and redesign risk inherent in bulk mining megaprojects.

Technical Brief

- For bulk megaprojects of this scale, shared multi-user rail–port corridors and staged brownfield expansions are becoming the dominant risk-mitigation model.

Our Take

Simandou’s planned 120 mtpa of high-grade iron ore sits alongside other iron ore coverage in our database that increasingly highlights premiums for >65% Fe material, suggesting these Guinea tonnes could structurally pressure margins at lower-grade Australian and Indian suppliers once rail and port are de-risked.

The Wa’ad Al Shamal phosphate complex in Saudi Arabia links into the ‘critical minerals’ and ‘energy transition metals’ theme that appears across 32 keyword-matched pieces, signalling that fertiliser-linked bulk projects are now being analysed in the same strategic frame as battery metals because of food security and decarbonisation of agriculture.

Carmichael’s large initial capex envelope and subsequent scale-back to a 10 mtpa operation aligns with other coal coverage in our database where greenfield thermal coal projects outside Asia face capital rationing and social-licence constraints, implying future bulk mine megaprojects may favour iron ore and fertiliser over export steam coal in OECD jurisdictions.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.