Government policies to drive mining investment in 2026: key takeaways for project teams

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

Government policy is set to dominate mining investment in 2026, with 47% of respondents to White & Case’s Mining & Metals 2026 survey citing political variables and nearly 40% expecting state‑backed financing to be the main tool in developed markets. Some 73% foresee widening divergence between US and Chinese critical minerals policy, while a funding gap between the US and Europe is seen as a key opportunity, alongside risks of over‑expansion and a two‑to‑three‑year “gold rush” bubble. Copper and gold are viewed as the “sure bet” price risers, with gold miners seen as prime consolidation targets and strategic partnerships favoured over traditional M&A.

Technical Brief

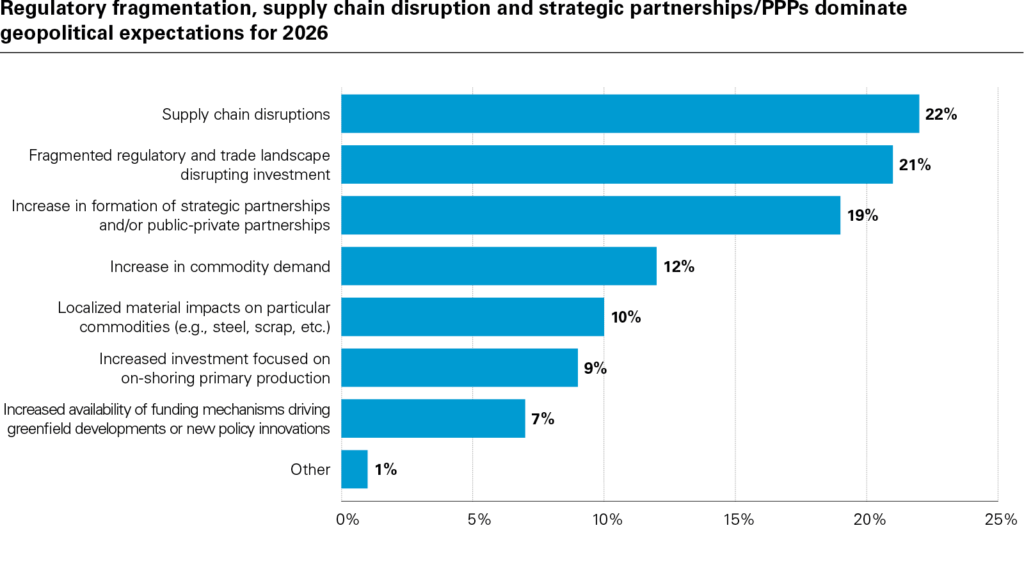

- White & Case’s Mining & Metals 2026 survey identifies supply chain disruptions in 2025 as a leading ongoing risk.

- Fragmentation of national critical mineral policies is cited by a similar share of respondents as a key concern.

- Respondents link unprecedented policy support and volatile trade rules directly to critical mineral supply security strategies.

- Survey participants see the US–Europe gap in government-backed funding as a concrete transactional opportunity window.

- White & Case warns policy-driven over-expansion could create an investment bubble, with a 2–3 year “gold rush” phase.

- Demand fundamentals are described as market-led, with policy support unable to fully offset weak end-use consumption.

Our Take

With 73% of respondents expecting greater US–China divergence on critical minerals policy, North American copper and lithium projects in our database increasingly reference reshoring or ‘friend-shoring’ strategies, which is already influencing where M&A bidders are willing to take jurisdictional risk.

The survey’s expectation that state-backed financing will be the dominant policy tool in developed markets aligns with recent coverage of brownfield copper and gold expansions, where public credit agencies are emerging as key participants in capex stacks rather than leaving funding solely to commercial banks.

Respondents flagging gold miners as the likeliest consolidation candidates dovetails with our broader Policy coverage, where gold appears more often in deal-making and restructuring stories than other commodities such as coal or rare earths, suggesting boards see M&A as a primary lever rather than greenfield build-out.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.