Global mining as a brownfield industry: risk and capex insights for project teams

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

Global mine development has shifted decisively to brownfield expansion, with a University of Queensland study of 366 sites in 58 countries showing brownfield capital dominated by copper (just under 50%), followed by gold (17.5%), iron ore (14.4%) and nickel (6.3%). Chile accounts for 25.2% of global brownfield capex, ahead of the US (11.4%) and Australia (10.1%), while minesite exploration by majors in Pacific and Southeast Asia has surged from 27.3% of budgets in 2010 to 76.8% in 2024. Nearly 80% of brownfield mines assessed via satellite sit in areas with multiple high-risk conditions, and over half lie within 20 km of biodiversity hotspots or protected areas, signalling tighter geotechnical, water and permitting constraints for future expansions.

Technical Brief

- Study covers 366 brownfield mine sites across 58 countries and 16 mineral commodities (1998–2024).

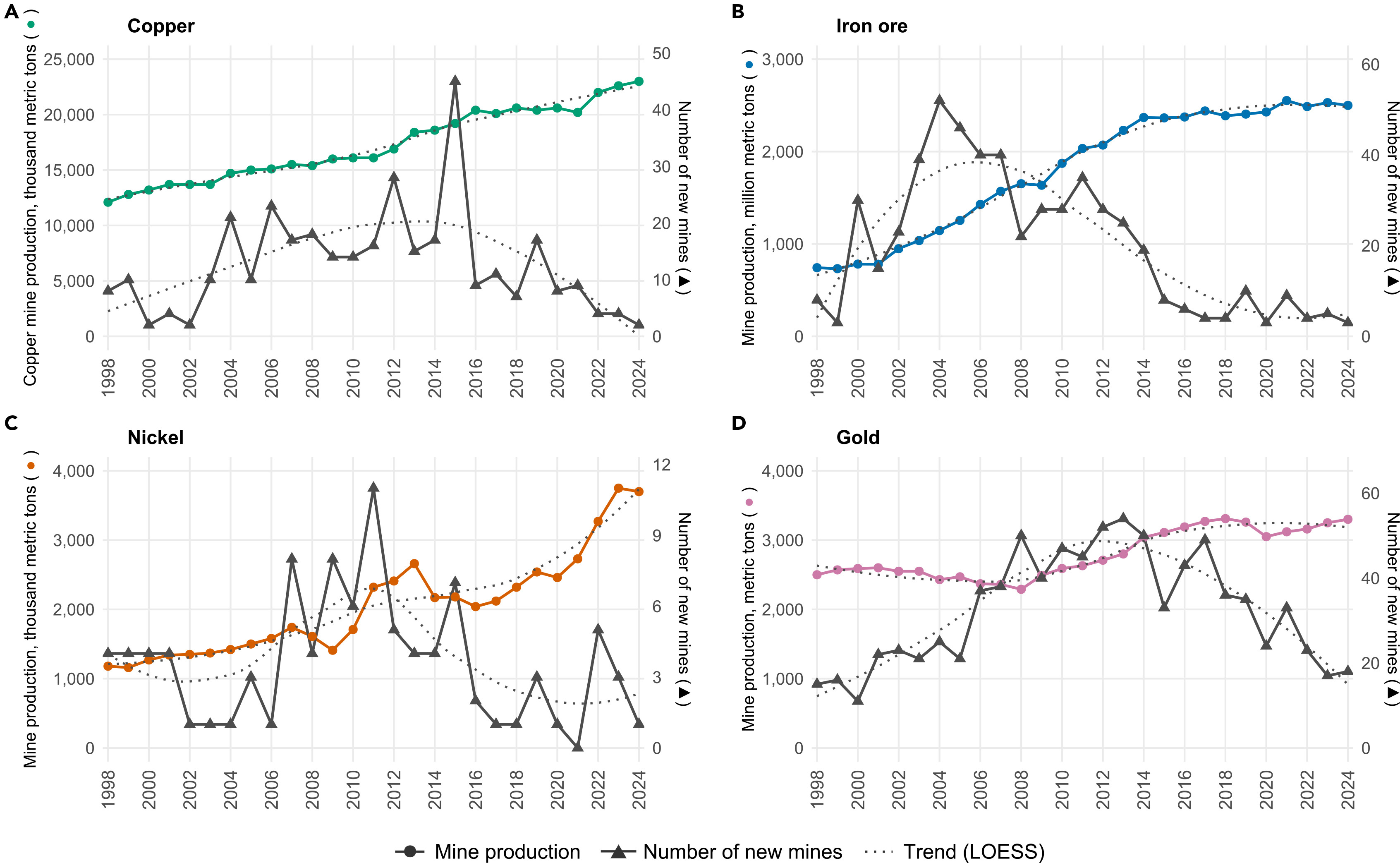

- Researchers combined global production, exploration and capex datasets, smoothing time-series trends using LOESS regression.

- New copper mines peaked around 2015, while iron ore, nickel and gold peaks occurred between early 2000s–2014.

- Brownfield growth is described as incremental, with stepwise regulatory approvals but cumulative social and environmental risk escalation.

Our Take

With copper accounting for just under half of brownfield capex in the study and a 14+4 year path from discovery to production, operators in regions like Latin America and Africa are likely to lean harder on incremental expansions at existing copper assets rather than betting on greenfield timelines that miss the 2030s demand window.

The sharp rise in minesite exploration shares in Pacific/Southeast Asia and Africa between 2010 and 2024 signals that brownfield optionality for critical minerals such as cobalt, nickel and copper is increasingly concentrated in jurisdictions where permitting, water stress and governance risks are already prominent in our sustainability-tagged coverage.

With nearly 80% of brownfield mines in multiple high-risk locations and over half within 20 km of biodiversity hotspots, ESG-screened capital for projects like Arizona Sonoran Copper’s Cactus brownfield development will likely hinge on demonstrating that expansions reduce the overall disturbance footprint versus equivalent greenfield capacity.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.