AI to boost copper demand 50% by 2040: project pipeline risks for mine planners

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

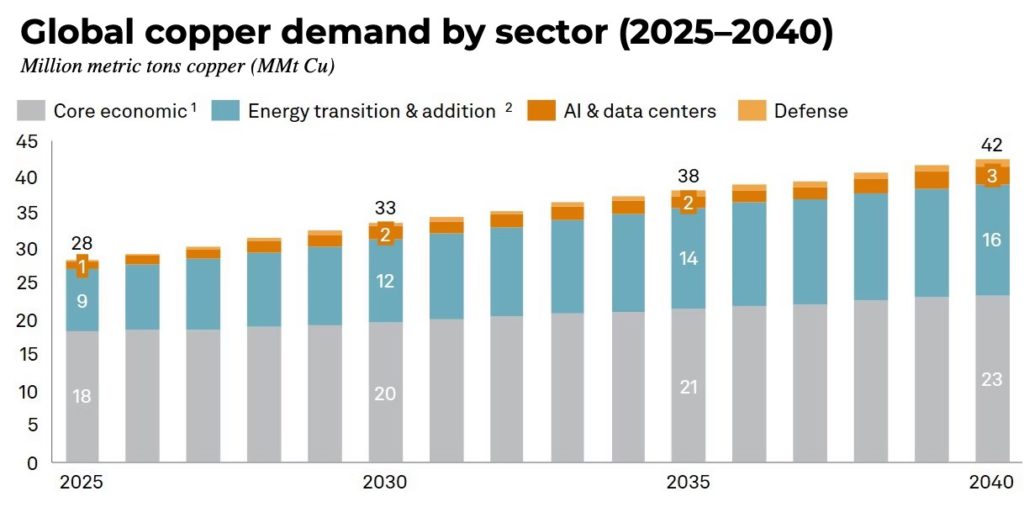

Rapid growth in AI data centres, defence spending and robotics is projected by S&P Global to lift annual copper demand 50% to about 42 million tonnes by 2040, leaving a potential supply gap of more than 10 million tonnes even if recycling more than doubles to 10 million tonnes. The study attributes roughly 4 million tonnes of extra annual demand to AI and defence alone, with a further 1.6 million tonnes possible if 1 billion humanoid robots are deployed, equivalent to about 6% of today’s consumption. Global mine output is forecast to peak near 33 million tonnes in 2030 as ore grades fall and new projects stall on permitting, financing and construction risk.

Technical Brief

- Copper prices already exceeded $13,000/t on the LME, driven by mine outages and US stockpiling.

- S&P notes consumption will ultimately be constrained by available supply, via price‑driven substitution and demand destruction.

- Long development timelines, rising capex and a highly concentrated supply chain increase execution and geopolitical risk for new copper projects.

Our Take

The projected 42 Mt/y copper demand by 2040 would materially tighten the market for operators like Gunnison Copper and Taseko’s Florence and Gibraltar projects highlighted in our recent rankings piece, giving low-cost in-situ and brownfield expansions greater strategic leverage in offtake talks.

With recycled copper only expected to reach about 10 Mt/y by 2040, traders such as Trafigura, Mercuria and Gunvor named in this piece are likely to see scrap and secondary material become a more contested feedstock, reinforcing the value of long-term access to high-quality recycling streams in Europe, China and North America.

In our database of 519 Mining stories, copper consistently appears alongside ‘critical minerals’ and ‘AI’ tags, signalling that diversified majors like BHP, Rio Tinto and Glencore are increasingly framing copper growth projects as both energy-transition and digital-infrastructure plays when pitching to investors and regulators.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.