Agnico Eagle, Ivanhoe Electric, District Metals: MDC rankings insights for mine planners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

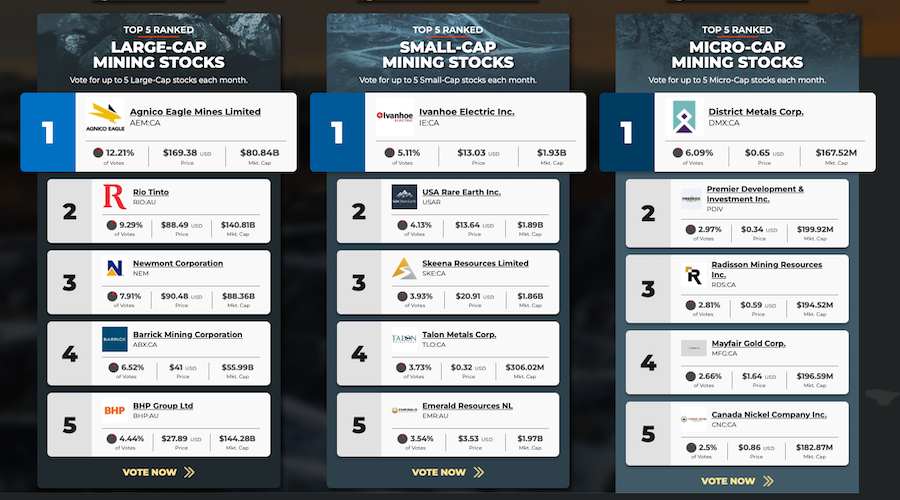

Agnico Eagle topped MINING.COM’s November Global Mining Power Rankings large-cap category with 12.21% of votes, backed by a 108% Toronto share price gain over 12 months, reaffirmed 2024 guidance of 3.3–3.5 Moz and on-schedule underground expansion at Canadian Malartic, plus an $80 million Avenir Minerals critical minerals push following a $180 million stake in Perpetua’s Stibnite gold‑antimony project. Ivanhoe Electric led small caps with 5.1% of votes on progress at the Santa Cruz copper project in Arizona and a “technology-driven” US exploration platform. District Metals headed micro caps with 6.1% after Sweden lifted its seven-year uranium mining ban, improving the outlook for its Viken uranium‑vanadium project with an inferred 1.5 billion lb uranium resource and a market value above C$153 million.

Technical Brief

- Agnico Eagle’s large-cap win drew 12.21% of votes, signalling strong confidence in its operating portfolio.

- Voting support cited “clean operating story” despite sector-wide inflationary pressure on mining opex and capex.

- Balance sheet strength at Agnico Eagle is contrasted with peers facing higher cost and jurisdictional risk exposure.

- Rankings are derived from investor, analyst and industry insider voting, functioning as a real-time sentiment proxy.

Our Take

Agnico Eagle’s reaffirmed 2024 gold output of 3.3–3.5 Moz positions it at the upper end of the pure-play gold producers tracked in our Mining category, which helps explain why it consistently features in our gold-focused coverage relative to peers like Newmont that are juggling portfolio rationalisation.

The $180 million exposure to Perpetua Resources’ Stibnite gold–antimony project gives Agnico Eagle leverage to a US-based critical mineral (antimony) at a time when most antimony supply in our database is still dominated by Asia, which may appeal to investors focused on Western-aligned supply chains.

District Metals’ 1.5 billion lb inferred uranium–vanadium resource at Viken in central Sweden stands out in our Projects-tagged pieces, as most recent uranium items are in Canada or the US; that geographic diversification could become a differentiator if European utilities push for regional uranium options.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Tunnelling

Specialised solutions for tunnelling projects including grout mix design, hydrogeological analysis, and quality control.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.