US titanium capacity squeeze: supply-chain and project signals for engineers

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

Western aerospace manufacturers are forecast to need 1.6 million tonnes of titanium by 2044, yet the US has no domestic sponge production since the Henderson, Nevada plant closed in 2020 and now relies on imports from Russia- and China-dominated supply chains, where China’s share of titanium metals has surged from 40% in 2019 to over 75% in 2025. Project Blue’s Nils Backeberg notes US ilmenite and rutile mining is largely tied to TiO₂ pigment, not aerospace-grade metal, making new melt and sponge capacity critical. Timet is responding with an $868 million, 500,000 sq ft “Project Aero” titanium melt/rolling facility in North Carolina (target 2027), a new microgrid-powered melt plant in West Virginia, and an 8,500 t/y electron-beam ingot expansion in Pennsylvania, signalling tighter qualification and sourcing pressures for defence and aviation programmes.

Technical Brief

- Over 90% of globally mined titanium feedstock is processed into TiO₂ pigment rather than metal.

- US titanium mining in Florida, Georgia, Virginia and Quebec supplies pigment plants, not aerospace metal flows.

- Titanium sponge is identified as the critical bottleneck step between mineral feedstock and certified aerospace ingot/alloy production.

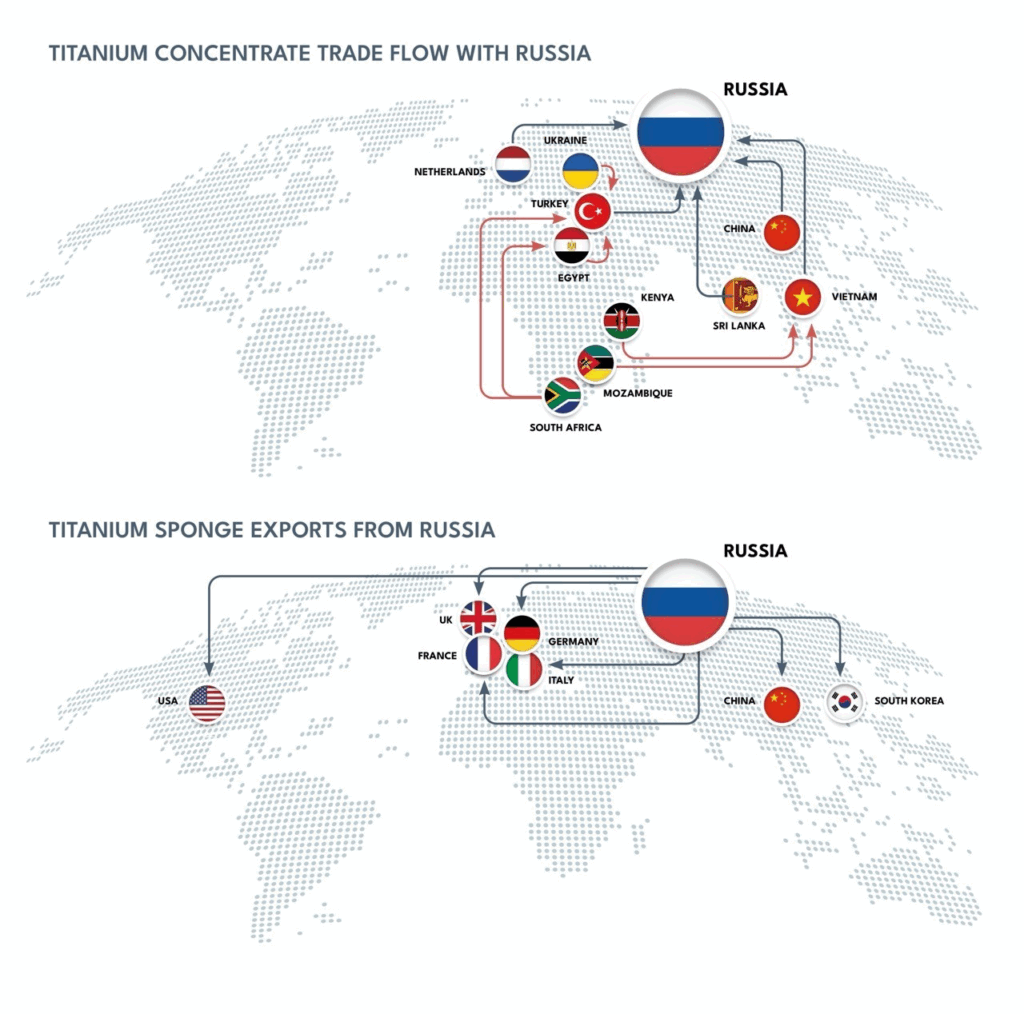

- Russia remains the leading supplier of aerospace‑grade titanium sponge into Western defence and aviation supply chains.

- China’s titanium metals share rose from 40% (2019) to over 75% (2025), alongside tightening export controls.

- Project Blue’s “Metals and the Security of Nations” report links titanium and rare earths to strategic supply‑chain vulnerability.

Our Take

Titanium and titanium dioxide appear in only a handful of keyword-matched pieces in our database, so the scale of China’s projected >75% share of titanium metals by 2025 stands out compared with more diversified supply patterns seen in better-covered commodities like copper and gold.

The closure of US sponge capacity in 2021 and the 2020 shutdown of the Henderson plant mean Timet’s planned $868 million North Carolina facility effectively becomes a strategic anchor for any US attempt to rebuild a full titanium value chain rather than just add downstream melt capacity.

With Western aerospace titanium demand projected at 1.6 million tonnes by 2044 and defence potentially taking 20% or more of total titanium consumption, US-based projects in Nevada, West Virginia and Pennsylvania are likely to find strong support from both aerospace primes such as Airbus SE and defence planners seeking to de-risk dependence on China and Russia.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.