St Barbara’s Canadian push: project economics and mine planning notes for engineers

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

Australia’s St Barbara is launching an aggressive 697 sq. km exploration campaign in Nova Scotia around its planned 15-Mile open pit hub, targeting 56 mesothermal gold prospects along 164 km of anticlines in the Moose River Formation and Goldenville Group, with fieldwork from May using surface sampling and reverse circulation drilling. A prefeasibility study for 15-Mile outlines 103,000 oz/year over 11 years at AISC of $1,188/oz, with a C$283 million Touquoy plant relocation expected to be repaid in about 12 months at $3,000/oz gold. Concurrently, St Barbara is exiting Simberi in Papua New Guinea via a sale of 50% to Lingbao Gold Group and Kumul Mineral Holdings for up to A$470 million to fund a $325–345 million sulphide expansion to 200,000 oz/year.

Technical Brief

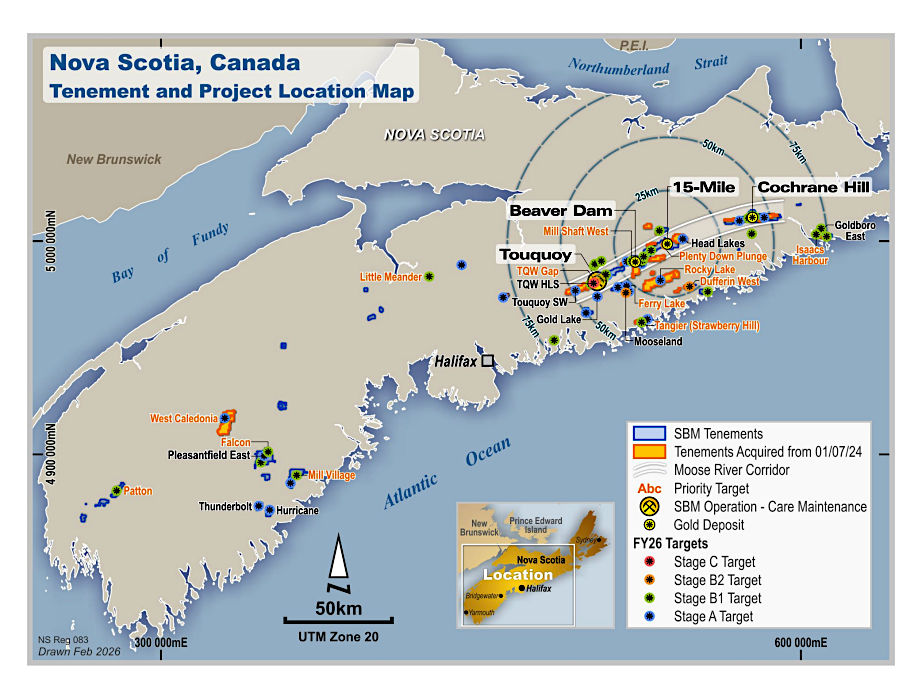

- Landholding covers 697 sq. km, consolidating 164 km of prospective anticlines around the 15-Mile hub.

- Within a 75 km radius of the hub, 56 structurally controlled targets have been delineated.

- Moose River Formation is exposed or under <30 m cover along 75 km of strike length.

- Structural targeting is being refined using newly acquired geophysical datasets before surface sampling and RC drilling.

- Additional tenure at Rocky Lake is aimed at testing northeast extensions of the Mooseland Anticline.

- Post-tax NPV for 15-Mile is estimated at A$1.4 billion with an 80% IRR at $3,000/oz.

- Touquoy plant relocation and infrastructure rebuild are budgeted at C$283 million, with ~12‑month payback assumed.

- Sale of 50% of Simberi to Lingbao Gold Group and Kumul Mineral Holdings could yield up to A$470 million.

Our Take

An A$1.4 billion post-tax NPV and 80% IRR for the 15-Mile gold hub put St Barbara’s Canadian push at the very top end of project economics in our Mining database, signalling room for cost overruns or schedule slippage without killing value.

Relocating the Touquoy plant for C$283 million with a 12‑month payback implies a strong preference for re-using existing processing infrastructure over greenfield build, which typically shortens permitting and construction risk in Nova Scotia compared with a new mill.

Divesting 50% of Simberi to Lingbao Gold Group and Kumul Mineral Holdings for up to A$470 million while committing A$325–345 million to a sulphide expansion suggests St Barbara is rotating capital from higher‑risk Papua New Guinea exposure into a more scalable Canadian gold platform.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.