Silver market deficit to 2026: BMI price drivers and mine supply notes for engineers

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

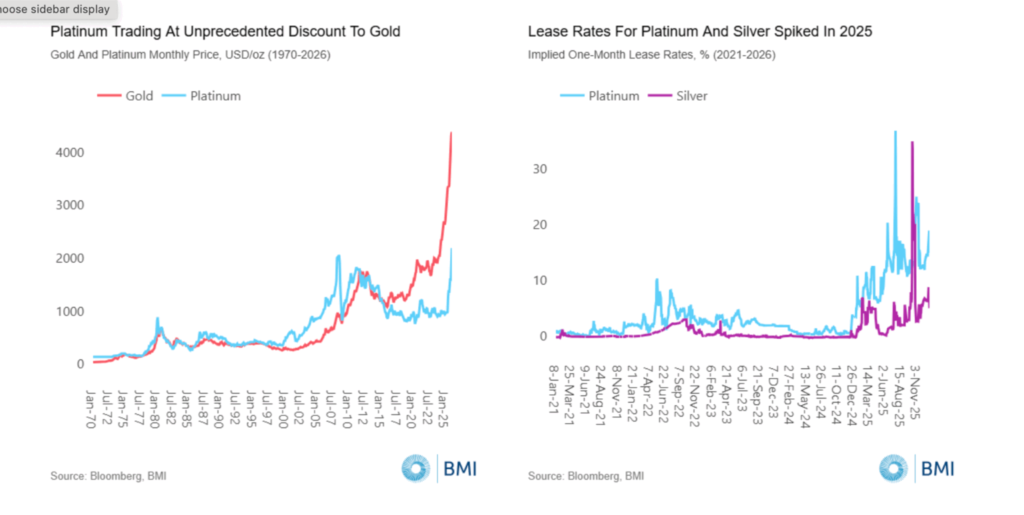

Silver prices that surged 143% in 2025 to nearly $80/oz are set to remain supported by a global market deficit through 2026, driven by ETF inflows and industrial demand from solar panels and EVs, according to Fitch’s BMI. Beijing’s January curbs on physical silver exports have tightened inventories in London and Zurich, briefly pushing one‑month equivalent lease rates above 8%, while Mexico’s output is constrained by declining grades and reduced operations at Fresnillo’s San Julián mine. BMI contrasts this with platinum, where futures above $2,000/oz after the EU delayed its 2035 ICE vehicle ban are seen as out of line with only modest 2026 industrial demand growth and higher recycling.

Technical Brief

- Beijing’s export curbs from 1 January directly squeezed London and Zurich vaulted silver inventories.

- One‑month equivalent silver lease rates briefly exceeded 8%, signalling acute short‑term physical tightness.

- BMI attributes silver’s investment appeal partly to its discount versus gold in portfolios and jewellery.

- Central bank activity, dominant in gold, is described as having “no meaningful role” in silver demand.

- Mexico’s constrained output is linked to declining ore grades plus partial shutdown at Fresnillo’s San Julián.

- Platinum futures on NYMEX traded above $2,000/oz after the EU delayed its 2035 ICE sales ban.

- The EU postponement announcement on 16 December triggered a 31% platinum price rally to $2,471/oz by 26 December.

- A subsequent 29 December sell‑off saw platinum fall almost 15% in a single session, the sharpest drop since August 2001.

- BMI expects only moderate platinum industrial demand growth in 2026, with higher recycling offsetting reduced South African mine output.

Our Take

BMI and Fitch Solutions have been central to several recent price-call pieces in our database, and their 2026 silver deficit view lines up with earlier forecasts that most precious and industrial metals, including silver and copper, will average higher in 2026 as trade frictions ease.

The extreme silver price and lease-rate moves cited here echo the 7.2% intraday silver spike to $85.73/oz in the 12 January 2026 safe-haven rally, suggesting that any supply tightness through 2026 could be amplified by macro shocks rather than mine fundamentals alone.

With Mexico and Fresnillo’s San Julián mine again in focus, continued silver tightness through 2026 implies sustained pricing power for low-cost Mexican primary silver producers, while higher-cost by-product silver from copper and gold operations in the USA and China will be more sensitive to cross-commodity price swings.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.