Rio Tinto slips, Agnico tops $100bn: portfolio signals for mining project teams

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

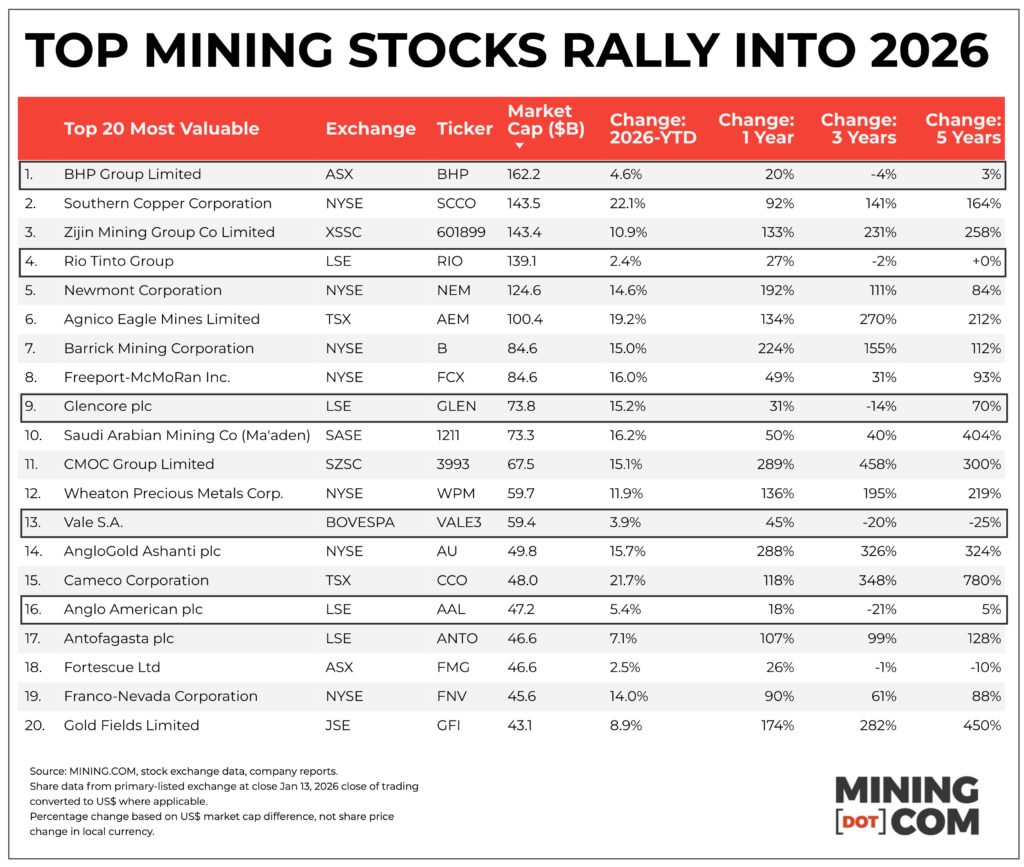

Gold edging towards $5,000/oz, record copper prices and a broad-based metals rally have pushed the MINING.COM Top 50’s combined market value beyond $2 trillion, with six miners – including newcomer Agnico Eagle at just over $100 billion – now above the triple‑digit billion mark. Rio Tinto has slipped to fourth place at about $140.8 billion, lagging Zijin and Southern Copper, as investors question a potential Glencore tie‑up that could create a “copper king” producing around 1.6 Mt/y by 2028 and over 2 Mt/y in the early 2030s. Meanwhile, diversified majors BHP, Rio Tinto, Glencore, Vale and Anglo American continue to underperform more focused copper and gold specialists over three‑ to five‑year horizons.

Technical Brief

- Combined market value of the MINING.COM Top 50 now sits “comfortably” above $2 trillion.

- Agnico Eagle only just crosses the $100 billion threshold, joining the triple‑digit billion cohort.

- Rio Tinto’s London market capitalisation is $140.8 billion after a 2.2% year‑to‑date gain.

- BHP’s valuation is $162 billion, up 4.6% in 2026, still short of double‑digit growth.

- Glencore has risen 15.2% in London to $73.9 billion amid ongoing Rio Tinto tie‑up discussions.

Our Take

The implied 1.6–2 Mt/y merged copper output for a hypothetical Rio Tinto–Glencore combination would put ‘RioCore’ clearly ahead of the 1.3 Mt/y BHP–Codelco pairing cited in the article facts, signalling how consolidation among diversified majors is increasingly framed around copper scale rather than iron ore or coal.

In our database of 592 Mining stories, copper and other critical minerals now dominate the upper end of valuation discussions, with gold-focused Agnico Eagle a relative outlier among the six $100bn-plus firms, which may influence how capital is allocated between precious metals and base-metal growth pipelines.

The strong 2026 year-to-date gains for Glencore (15.2%), Southern Copper (22%), and Zijin (11%) compared with Rio Tinto’s 2.2% suggest that equity markets are currently rewarding pure or copper-heavy portfolios more than diversified bulk-heavy houses, which could pressure Rio Tinto and BHP to accelerate copper project approvals or M&A by the late 2020s.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.