Planning and Infrastructure Act 2025: key takeaways for project teams

Reviewed by Joe Ashwell

First reported on The Construction Index

30 Second Briefing

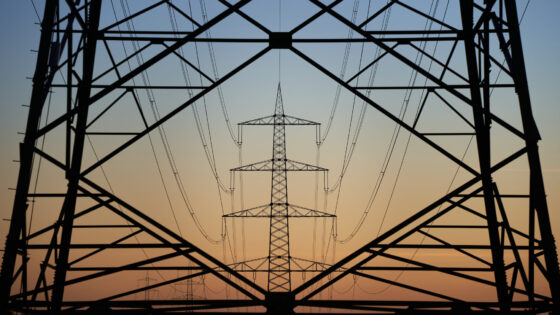

Landmark Planning and Infrastructure Act 2025 has received royal assent, giving ministers new powers to accelerate major roads, rail schemes, reservoirs, windfarms and grid connections, and underpinning Labour’s target of 1.5 million new homes. Key measures include a Nature Restoration Fund for centralised biodiversity offsetting, streamlined judicial review with only one court challenge allowed on meritless major project cases, and reformed local authority planning committees pushing smaller schemes to officers. The Act also simplifies EV charger approvals, eases compulsory purchase, and offers up to £250/year electricity bill discounts for 10 years to households near new pylons.

Technical Brief

- Royal assent converts the Planning and Infrastructure Bill into the Planning and Infrastructure Act 2025.

- New powers explicitly target faster delivery of reservoirs, roads, railways, windfarms and other “critical infrastructure”.

- Compulsory purchase order reforms lower procedural barriers for the state to acquire private land for schemes.

- Centralised Nature Restoration Fund creates a pay-in mechanism for biodiversity and habitat damage offsetting.

- Judicial review changes cap objectors on “meritless” major project cases to a single court challenge.

- Local authority planning committees are refocused onto only the most “significant” schemes, delegating minor consents.

- Government explicitly cites stalled schemes like Lower Thames Crossing and Sizewell C as target beneficiaries of the Act.

Our Take

Within the 56 Policy stories in our database, the UK features frequently for grid and housing bottlenecks, so tying the Lower Thames Crossing and Sizewell C to a statutory planning framework signals an attempt to unblock nationally significant infrastructure rather than just tweak guidance.

The £250/year electricity bill discount for up to 10 years near new pylons is unusually explicit community compensation in our UK coverage, and is likely to become a reference point for future negotiations around transmission corridors for projects like Sizewell C grid connections.

A target of 1.5 million homes in the United Kingdom, combined with sustainability-tagged standards, will push local authorities and developers towards denser, infrastructure-led schemes, which in our past Policy pieces has tended to favour brownfield regeneration over more contentious greenfield expansion.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.