Latin America’s 75% share of mining M&A: project pipeline lens for engineers

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

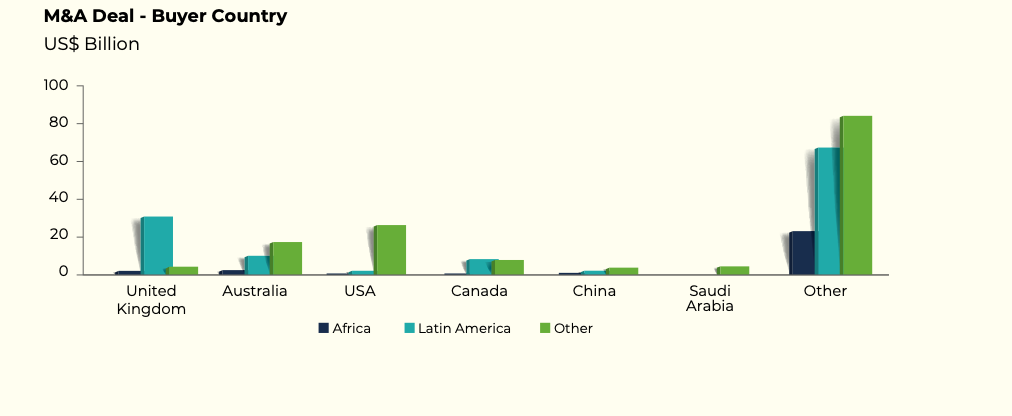

Global mining M&A reached about $30 billion in the first three quarters of 2025, with 74% of deal value directed to Latin America and deal values in the region up more than 200% since 2021, while Africa’s have fallen nearly 80%. McKinsey and the Future Minerals Forum’s 2025 barometer reports that over 50% of global critical mineral reserves lie in Africa, West Asia and Central Asia, yet exploration spending there is the lowest worldwide and remains 40%–50% below required levels. The report estimates $5 trillion of cumulative investment is needed by 2035, with 16‑year discovery‑to‑production timelines and a projected 75% rise in copper demand to 56 Mt/y by 2050 requiring roughly 60 new Quellaveco‑scale mines.

Technical Brief

- More than 45% of refined EV-material output is concentrated in a single region, heightening supply-chain fragility.

- Mining productivity has risen only ~1% per year since 2018, constraining organic supply growth despite higher prices.

- Long permitting timelines, infrastructure gaps and high capital intensity are identified as primary bottlenecks to new mine delivery.

- The Future Minerals Barometer integrates stakeholder sentiment, market data and project-level evidence into a single decision-support platform.

- Africa, West Asia and Central Asia (“Super Region”) hold >50% of critical mineral reserves but attract the lowest global exploration spend.

- Anglo American’s Duncan Wanblad equates projected copper demand growth to developing ~60 Quellaveco-scale mines within a decade.

Our Take

Using Quellaveco as the reference scale for the 60 new copper mines implied in McKinsey’s outlook underlines how much of the future supply gap hinges on Peru- and Chile-style large open pits, which typically face long permitting and social-licence lead times in Latin America.

In our database of 601 Mining stories, copper consistently dominates the ‘Projects’ and ‘Sustainability’ tag overlap, suggesting that the projected 75% rise in copper demand by 2050 will likely keep pushing operators towards lower-grade, higher-strip deposits with more complex ESG footprints in Chile and Peru.

The combination of a 16‑year discovery‑to‑production timeline and exploration spend running 40–50% below requirements implies that many battery metals and critical minerals projects in the so‑called Super Region will need to rely on brownfield expansions and M&A rather than greenfield discoveries to meet 2030–2035 targets.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.