AML magnet materials: supply-chain and design implications for engineers

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

Advanced Magnet Lab (AML) is scaling a wire-like manufacturing process for permanent magnets, enabling samarium nitride and manganese-bismuth compositions that are poorly suited to conventional press-and-sinter NdFeB routes dominated by China. Operating at pilot scale and targeting roughly 100 tonnes per year rather than 10,000-tonne megaprojects, AML is qualifying MnBi magnets with motor OEMs and ramping NdFeB output for defence and specialty uses, with samarium nitride furthest advanced. OEMs are reportedly paying US$10–20/kg premiums for diversified, traceable supply, while magnet-making equipment faces 14–20 month lead times.

Technical Brief

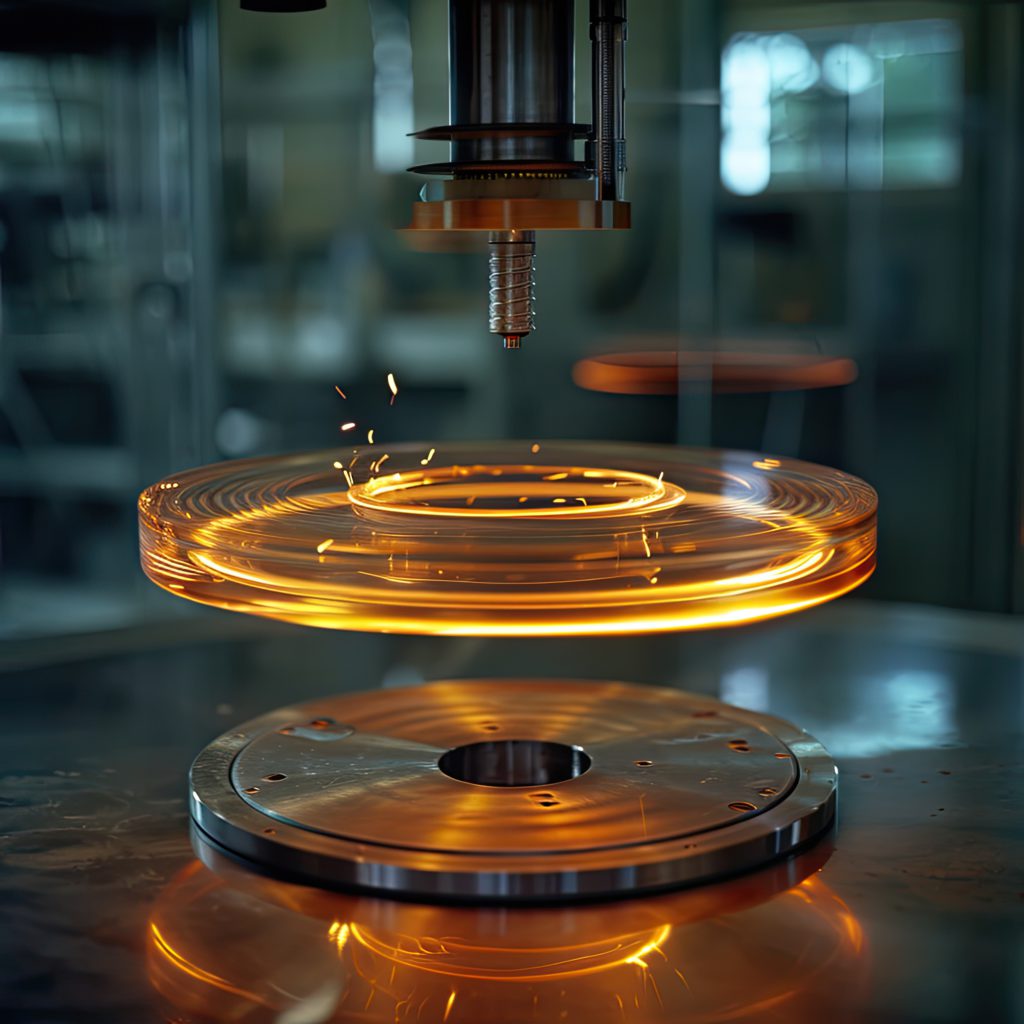

- AML’s process mimics continuous superconducting wire production rather than batch press-and-sinter of compacted powders.

- Traditional sintered magnet plants see 60–70% of finished magnet cost tied directly to raw materials.

- Capital intensity and entrenched IP around sintered NdFeB lines are cited as key barriers to new entrants.

- AML’s early patent filings (circa 2015–2016) pre-dated US–China trade tensions and reshoring incentive schemes.

Our Take

With raw materials like neodymium and other rare earths accounting for 60–70% of NdFeB magnet pricing, AML’s focus on alternative chemistries such as samarium nitride or manganese-bismuth directly targets the cost structure rather than just incremental process efficiency.

The 14–20 month lead times for magnet-making equipment mean any new USA- or EU-based capacity responding to critical minerals policy will lag OEM demand into the early 2026 horizon, so AML’s 100 t/y target looks more like a near-term niche supply play than a full substitute for Chinese volumes.

Our Materials coverage has only a limited number of boron- and critical-minerals-tagged pieces that deal with magnet performance rather than mine supply, so AML’s work sits at the downstream end of the value chain where OEMs are signalling they will pay a US$10–20/kg premium for diversified sourcing.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

QCDB-io

Comprehensive quality control database for manufacturing, tunnelling, and civil construction with UCS testing, PSD analysis, and grout mix design management.