Agnico, Aya and Gunnison in MDC December rankings: project and cashflow notes for mine planners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

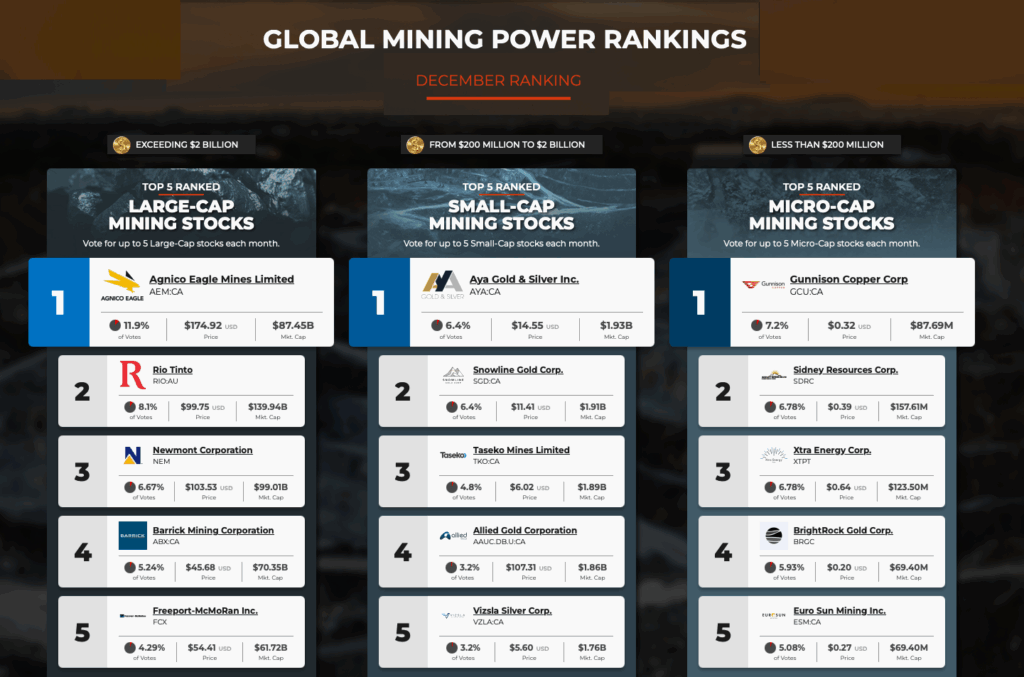

Agnico Eagle, Aya Gold & Silver and Gunnison Copper led MINING.COM’s December Global Mining Power Rankings, with Agnico securing 11.9% of large-cap votes on the back of a reaffirmed 2025 output of 3.3–3.5 Moz, about $3.1 billion free cash flow in nine months and full debt elimination targeted by Q4 2025. Aya’s Zgounder mine in Morocco reached commercial production post-expansion and a PEA for its 85%-owned Boumadine project outlines an 11-year, multi-pit and underground polymetallic operation, supported by a roughly 160% silver price surge. Micro-cap winner Gunnison Copper produced first copper cathode at Johnson Camp in Arizona in 2025, began sales in September and secured about $13.9 million in US DOE Section 48C tax credits, signalling momentum for US in-situ copper supply.

Technical Brief

- Agnico’s Canadian Malartic underground expansion is reported on schedule and within original guidance parameters.

- Share price performance for Agnico reached +116% in Toronto and +125% in New York over 12 months.

- Avenir Minerals Limited was launched by Agnico to deploy roughly $80 million into early-stage critical minerals.

- Agnico previously committed $180 million to Perpetua Resources’ Stibnite gold–antimony project in Idaho, expanding US-facing exposure.

- Around $1 billion of Agnico’s 2025 free cash flow has been allocated to share buybacks alongside higher dividends.

Our Take

With Agnico Eagle’s free cash flow run-rate of $6.8 billion and a 2025 production outlook of 3.3–3.5 million oz of gold, the company sits at the capital-rich end of our gold coverage universe, giving it unusual latitude to fund both brownfield expansions like Meliadine and opportunistic stakes such as Perpetua’s Stibnite without balance-sheet strain.

Aya Gold & Silver’s 85% ownership of the Boumadine polymetallic project and an 11-year envisaged mine life place it among the more leveraged silver names in our database at a time when the 2025 silver price surge of about 160% has sharply improved project economics for similar North African polymetallic assets.

Gunnison Copper’s receipt of $13.9 million in US DOE Section 48C tax credits aligns with other North American copper items in our coverage where public incentives are increasingly decisive for in-situ and lower-footprint projects, especially as deep seabed mining for critical minerals remains legally blocked according to the December 30, 2025 seabed-governance piece.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Tunnelling

Specialised solutions for tunnelling projects including grout mix design, hydrogeological analysis, and quality control.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.