Venezuela shock lifts gold: project pipeline and risk takeaways for mine planners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

Gold prices jumped 2.2% to $4,430/oz on 5 January after the US military raid that captured President Nicolás Maduro, extending a 2025 rally that saw records up to $4,547/oz and prompting BMI to lift its 2026 forecast to $3,700/oz. BMI and BloombergNEF note Venezuela’s mining output has collapsed over 2004–2024, with iron ore down from 20 Mt to 2 Mt, bauxite from 5 Mt to 0.3 Mt and coal to under 0.5 Mt, amid nationalisation, degraded infrastructure and security risks. Prospects hinge on poorly explored critical minerals in the Arco Minero del Orinoco, where absent geological data, criminal control and competing oil investment mean only exceptional deposits are likely to draw capital even under a reformist regime.

Technical Brief

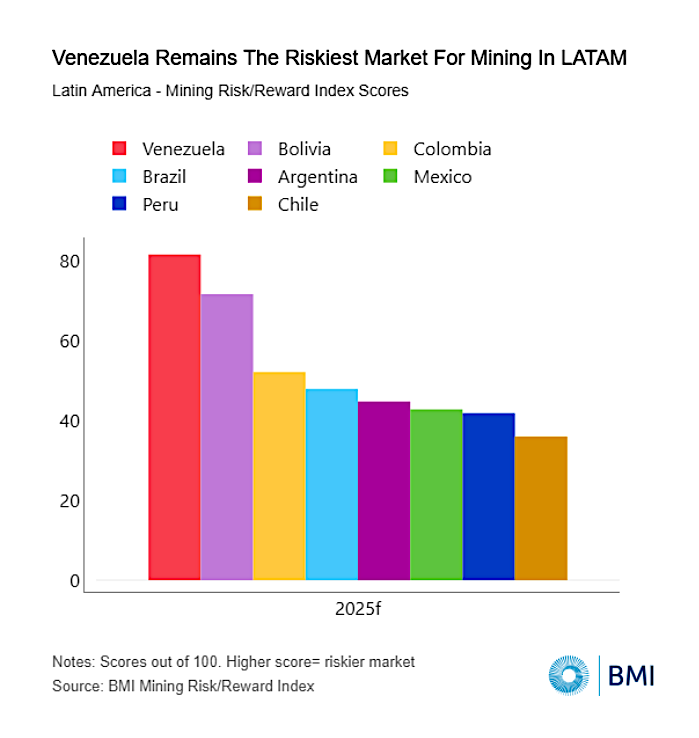

- BMI’s 2026–2035 outlook keeps Venezuela among Latin America’s smallest, least-attractive mining jurisdictions.

- Iron ore output collapse removed roughly 18 Mt/y of supply between 2004 and 2024.

- Gold operations in Bolívar and Amazonas are described as de facto controlled by guerrilla and criminal groups.

- Arco Minero del Orinoco is reported to host copper, nickel, coltan, titanium and tungsten prospects.

Our Take

BMI’s projection of a 44% year‑on‑year rise in the average gold price in 2025 aligns with its broader metals outlook in our database, where BMI and Fitch Solutions repeatedly flag structurally tighter precious‑metal markets from 2026 as trade frictions ease and net‑zero demand underpins pricing.

The roughly 90% collapse in Venezuela’s iron ore, bauxite and coal output over two decades means that, even if sanctions on oil and gold ease, the country has effectively lost much of the skills base and supporting infrastructure that underpins large‑scale mining projects elsewhere in Latin America.

With Anglo American valuing its 85% stake in De Beers at about $4.9 billion, the article’s juxtaposition of diamonds and Venezuelan gold underscores how capital is currently anchored in established jurisdictions and brands, suggesting that any Arco Minero del Orinoco revival would need unusually strong legal and ESG guarantees to compete for major‑miner investment.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.