South America as West’s safest minerals bet: risk and supply notes for mine planners

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

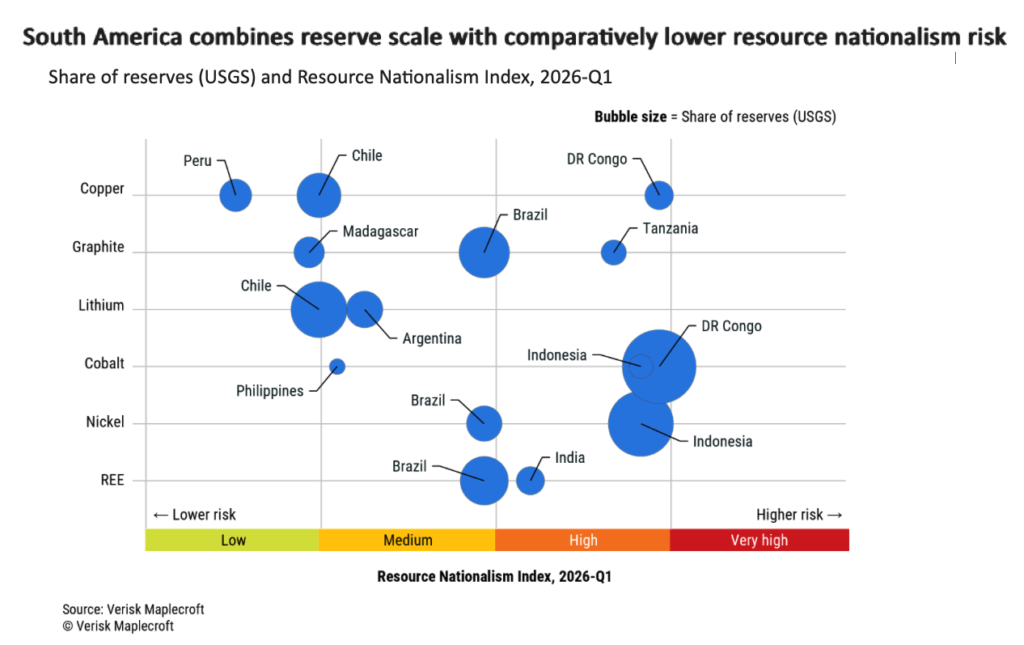

South America is identified by Verisk Maplecroft’s Resource Nationalism Index and Political Risk Data as the most stable option for Western critical mineral diversification, with Argentina, Brazil, Chile and Peru combining large lithium, copper, cobalt, nickel, graphite and rare earth endowments with moderate state intervention. DR Congo, Indonesia and Tanzania sit among the 20 most exposed jurisdictions globally, yet remain unavoidable for some minerals, as shown by the US Strategic Minerals Cooperation Framework with DRC and the EU’s rare earth-linked trade deal with India. Geopolitical Alignment Tool scores place Argentina and the Philippines as close US allies and Chile, Madagascar and India as strategically aligned, making South America a relatively low-risk anchor in a fragmented supply landscape.

Technical Brief

- Verisk Maplecroft benchmarked 10 emerging producers using its Resource Nationalism Index plus Political Risk Data.

- DR Congo, Indonesia and Tanzania fall within the 20 most resource‑nationalism‑exposed jurisdictions out of 198 assessed.

- Peru, Chile and Argentina are classed among the strongest global performers for low resource‑nationalism risk.

- Some states combine high political volatility with assertive state control, elevating risk of export bans or mandated beneficiation.

- India’s rare earths regime, and policy settings in DR Congo and Indonesia, exemplify tighter state control plus value‑add demands.

Our Take

Verisk Maplecroft also underpinned a January 27 piece in our database on Latin America’s ‘security zone’ status for lithium and copper, signalling that Washington’s push for a 55-country critical minerals bloc is being framed around the same Andean jurisdictions highlighted here.

Northern Star’s 49% first-half profit jump, tied to gold, sits against a backdrop of only a handful of gold-price pieces in our recent coverage, suggesting that cash-generative precious metals producers may become important internal financiers for diversification into copper, nickel or lithium assets in safer jurisdictions such as Chile and Brazil.

Across the 267 keyword-matched cobalt and copper items in our database, most high-grade new supply is still concentrated in higher-risk states like DR Congo and Indonesia, which likely reinforces why South American copper and nickel deposits are being treated as ‘premium’ options in Western supply-chain planning despite more mature regulatory regimes.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.