Silver price surpasses $90: project economics and capex signals for mine planners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

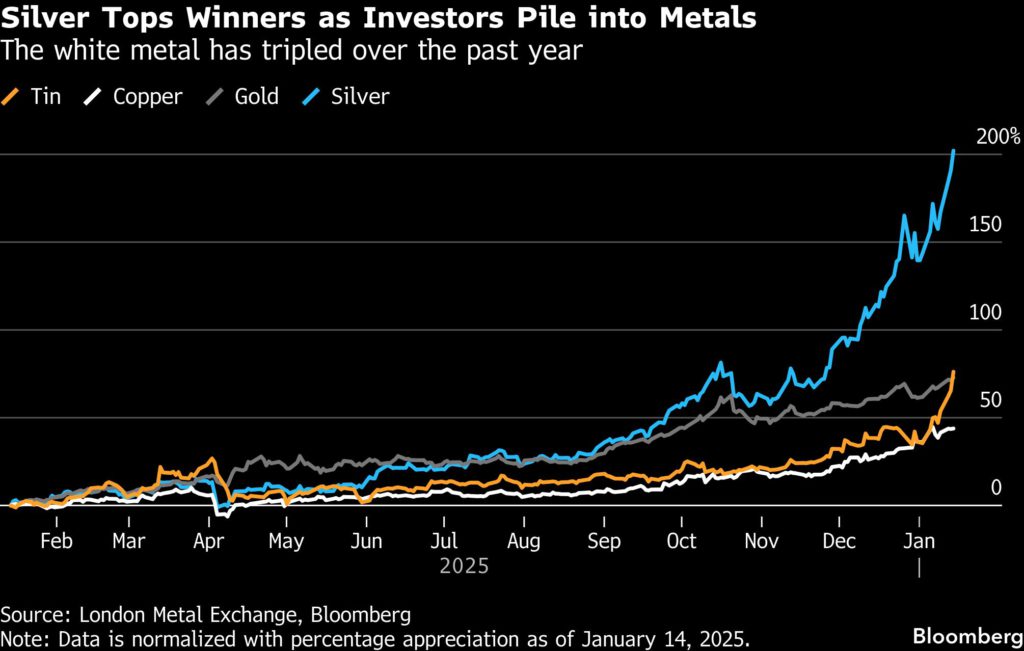

Silver has surged past $90/oz to a record $92.23, up over 14% year-to-date, while spot gold hit $4,641.29/oz, extending a 6% gain as safe-haven demand intensifies and investors rotate out of government bonds amid US debt and monetary policy concerns. UBS reports silver in a “perpetual state of backwardation”, with US tariff overhang and its critical minerals designation restricting flows to London and driving acute physical tightness. Citi now pegs three‑month targets at $5,000/oz for gold and $100/oz for silver, after 2025 gains of 65% and 150% respectively.

Technical Brief

- UBS reports silver in a “perpetual state of backwardation”, indicating persistent near-term supply tightness.

- Backwardation is being driven by restricted flows from the US to London, the main spot hub.

- Inclusion of silver on the US critical minerals list is a key trigger for potential import levies.

- Tariff overhang is physically trapping some silver in the US, reducing deliverable inventory elsewhere.

- UBS notes a feedback loop: tightness lifts prices, which then attracts further speculative length.

- For project economics, sustained backwardation and tariff risk materially affect offtake terms and hedging strategies.

Our Take

With silver above $90/oz and Citi flagging $100/oz in three months, marginal polymetallic and silver‑rich gold projects in the USA and Greenland—such as those held by juniors like Allegiance Gold or linked to critical minerals plays around the Tanbreez project—are likely to re‑run economics and push higher‑cost ounces into the mineable category.

In our Mining corpus, most gold and silver coverage has focused on project execution and permitting rather than price spikes, so a 150% annual gain in silver last year followed by a further 14% this year signals a pricing environment that could quickly outpace the assumptions embedded in many current feasibility studies and reserve statements.

The combination of elevated gold and silver prices with a critical minerals narrative around assets like Tanbreez in Greenland positions multi‑commodity deposits to attract more attention from institutional players such as UBS Group and Citi, which in turn can influence which projects secure financing in a tighter global capital market.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.