Silver price falls from record: volatility and storage signals for mine planners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

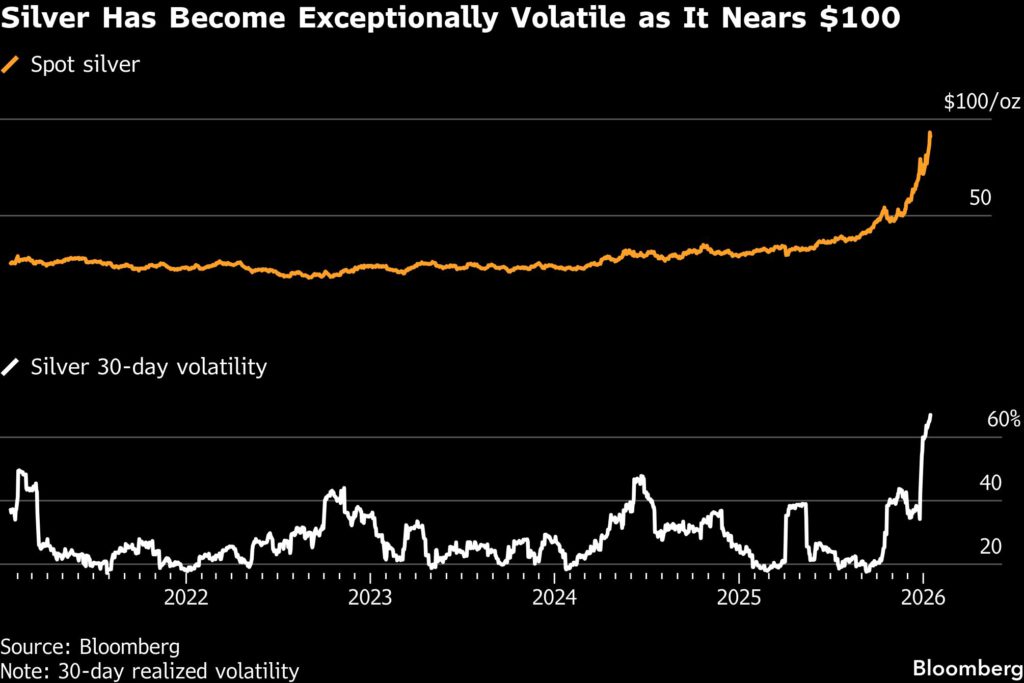

Silver fell as much as 7% from Wednesday’s record $93.75/oz after US President Donald Trump paused sweeping tariffs on critical minerals, instead signalling bilateral negotiations and possible price floors. Prices later stabilised near $90/oz, with about 434 million ounces now sitting in Comex-linked New York warehouses, roughly 100 million ounces more than a year ago, contributing to earlier short squeezes and thin-liquidity spikes. Analysts at StoneX and TD Securities warn that ongoing critical-mineral status, warehouse “sclerosis” and volatility-driven forced selling will keep silver price swings elevated despite a still “firmly constructive” medium-term outlook.

Technical Brief

- US review framed foreign critical mineral shipments, including silver, as potential national security threats.

- Trump’s shift from sweeping tariffs to bilateral deals introduces case-by-case trade risk for silver flows.

- Proposed price floors would effectively create a quasi-administered price band for critical mineral imports.

- Tariff fears earlier kept silver physically immobilised in US warehouses, tightening offshore availability.

- StoneX flags “sclerosis” in moving silver out of US, implying persistent logistics and regulatory friction.

- TD Securities notes a “surgical approach” should spare benchmark bars that underpin futures price discovery.

- Speculative buying surge in China added a distinct demand leg, compounding industrial and investment flows.

- Solar-sector industrial demand is specifically cited as a key structural pull on physical silver offtake.

Our Take

The $93.75/oz record for silver comes on top of a 143% price surge in 2025 to nearly $80/oz noted in our earlier coverage, signalling that current volatility is occurring against an already stretched cost curve for industrial users in solar and EV supply chains.

Comex-linked inventories in New York at 434 million ounces, up 100 million ounces year-on-year, contrast with the global market deficit highlighted in the 14 January silver outlook piece, suggesting that visible exchange stocks are less of a constraint than off-exchange and fabrication demand in driving price action.

The US hesitation on critical minerals tariffs in this article sits alongside the 8 January coverage of Amaroq Minerals’ talks with US agencies, underlining that Washington is still relying more on upstream access deals in places like Greenland than on broad trade barriers to secure critical minerals such as silver, copper and rare earths.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.