Fitch 2026 mineral and metal price outlook: planning notes for mine projects

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

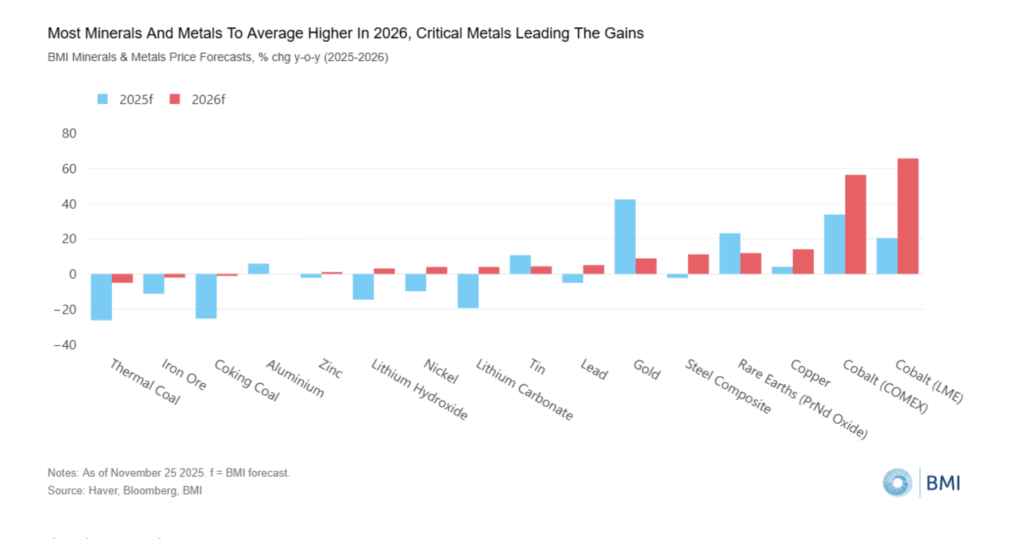

Most mineral and metal prices are forecast by BMI, a Fitch Solutions unit, to average higher in 2026 than in 2025 as trade frictions ease and demand from net-zero sectors supports copper, aluminium, lithium, nickel and rare earths despite continued weakness in Mainland China’s property market. A key risk is potential US tariffs on refined copper, with the Commerce Secretary due to report by 30 June 2026 on a possible universal duty of 15% from 2027 and 30% from 2028. Gold is expected to stay below about $4,000/oz by late 2026 as the Fed’s rate‑cutting cycle pauses and a relatively stable US dollar index around 95–100 caps further upside.

Technical Brief

- Proposed universal US duty on refined copper is 15% from 2027, rising to 30% from 2028.

- Tariff uncertainty peaked in August 2025, with BMI expecting a gradual decline in 2026.

- BMI flags potential renewed US tariff flare‑ups targeting specific metals to protect critical industries.

Our Take

The proposed universal 15–30% duty on refined copper from 2027–2028 would structurally favour new smelter and refining investments in the USA and Canada over Mainland China, and could make offtake terms from Latin American copper projects more complex as traders re‑route material to avoid US tariffs.

In our database of 480 Mining stories, BMI and Fitch Solutions appear mainly in price‑forecast and macro‑risk pieces rather than project finance, so these 2026–2028 calls on copper, lithium and rare earths are more likely to influence offtake pricing assumptions and hurdle rates than to signal specific project‑level commitments.

Linked with BMI’s earlier tin forecast upgrade to 2026, this cross‑commodity bullishness on critical minerals and industrial metals suggests project developers in Africa and Latin America may find it easier to secure offtake‑backed funding, but also face tighter construction and equipment markets if prices track these expectations.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.