EV battery metals index at 27‑month high: pricing and supply notes for miners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

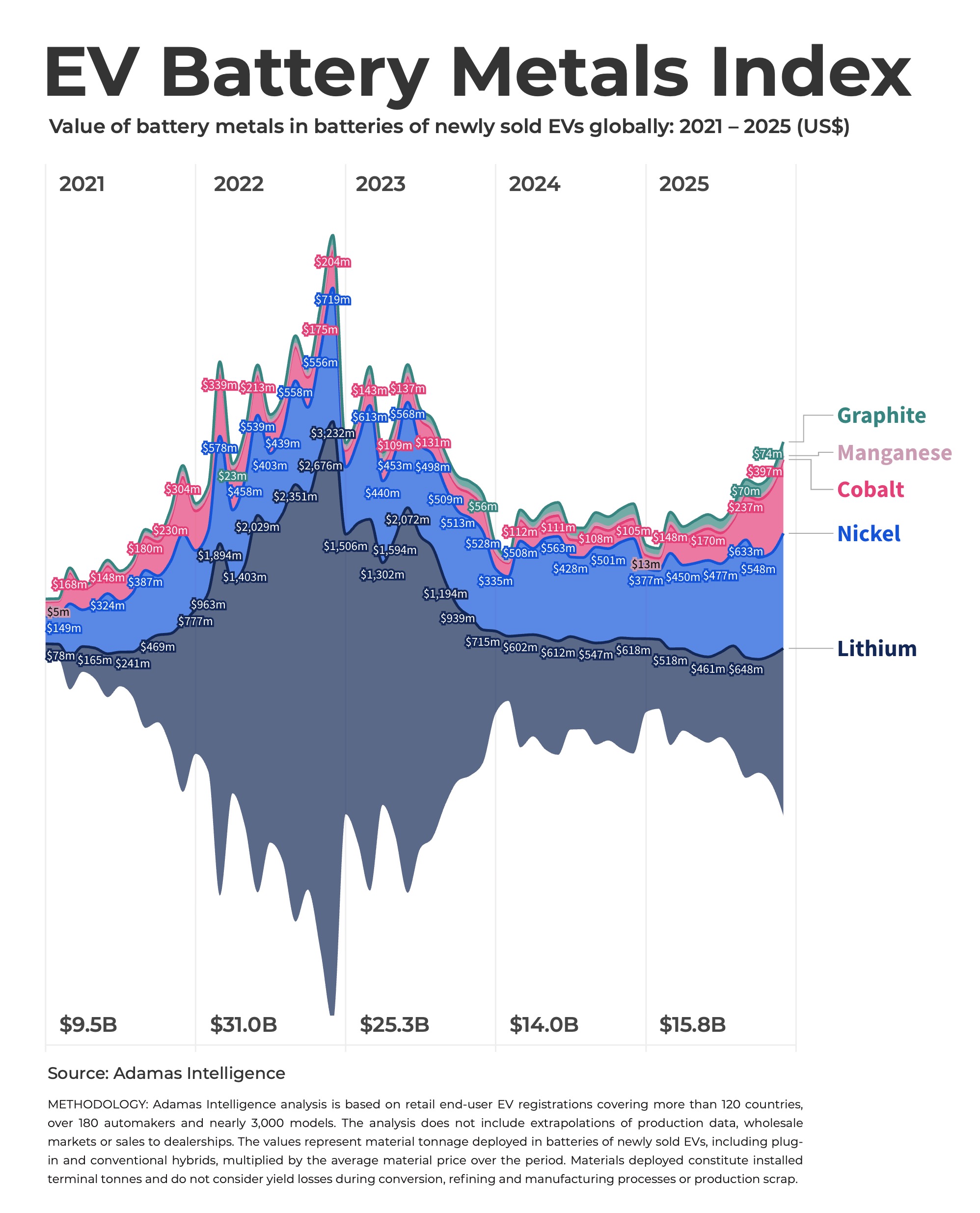

EV raw material spend for lithium, graphite, nickel, cobalt and manganese in newly sold passenger EVs reached $15.8 billion in 2025, up 13% year on year, with December’s monthly bill topping $2 billion for the first time since August 2023 as lithium hydroxide/carbonate and nickel sulphate prices climbed. Global EV battery capacity deployment is on track to exceed 1 TWh in 2025, nearly quadruple 2021’s 286 GWh, with LFP packs accounting for almost 50% of capacity and 83% of LFP roll-out concentrated in China. Cobalt’s share of the EV Metal Index rebounded to 14% ($2.4 billion) on >200% year-on-year sulphate price gains, while nickel and lithium each surpassed $6 billion in contained value, supported by high‑nickel NCM chemistries in the US and Europe despite growing LFP penetration.

Technical Brief

- EV Metal Index couples contained metal tonnages with prevailing battery‑grade prices to quantify value flow.

- Battery capacity deployment grew 25% year‑on‑year, outpacing the 20% growth in EV unit sales.

- Market size in GWh terms is now roughly four times 2021 and ten times 2019 levels.

- Cobalt sulphate prices were over 200% higher year‑on‑year by December, sharply lifting cobalt’s index share.

- Installed metal tonnage excludes processing, conversion and scrap losses, where yield losses often reach double‑digit percentages.

Our Take

The sharp rebound in cobalt sulphate pricing and its index share in 2025 contrasts with several energy-transition pieces in our database where cobalt was being de-emphasised in favour of LFP and manganese-rich chemistries, suggesting high-nickel and mid-nickel cathodes are proving more resilient than many OEM roadmaps implied.

With LFP already near 50% of global battery capacity and China accounting for 83% of that roll-out, the low LFP penetration in the USA (6%) and Europe (12%) implies significant room for chemistry substitution that could structurally cap lithium and nickel price upside for new projects in those regions.

Tesla’s 40% use of LFP on a GWh basis alongside CATL’s dominance in mid-nickel cathodes positions Chinese supply chains as the swing factor for both lithium and nickel demand, which aligns with other BYD-focused items in our coverage showing Chinese battery and EV makers increasingly shaping upstream investment signals outside China.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.