Copper’s tight supply and tariff risks: key 2026 signals for mine planners

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

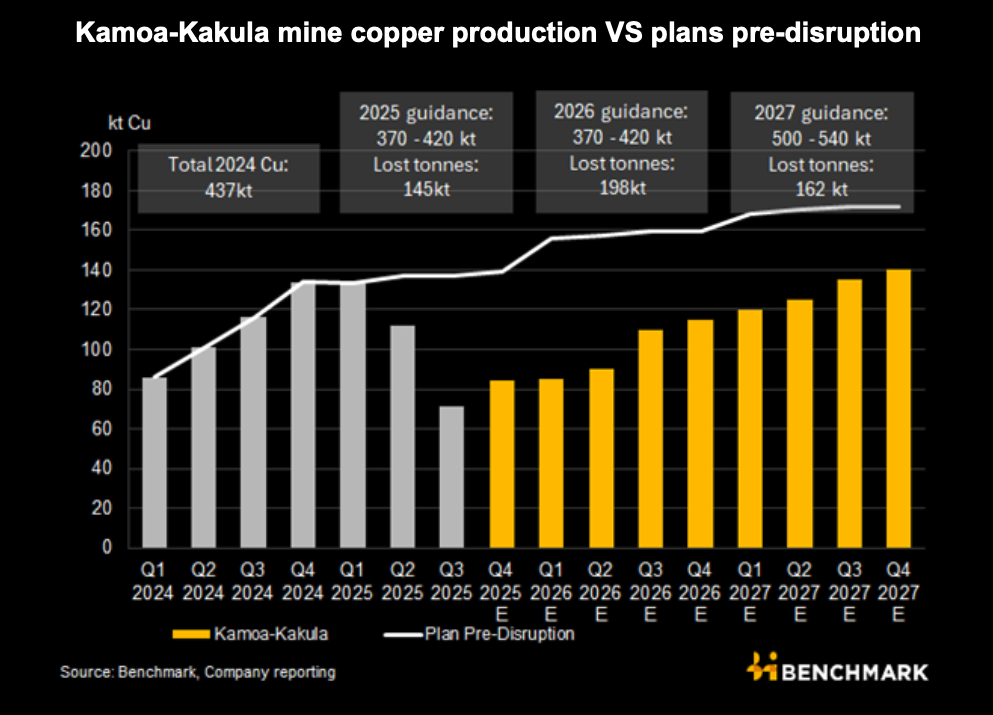

Copper prices have surged 35% in 2025 to above $11,800/t as traders diverted an estimated 730,000–830,000 t into CME-deliverable US warehouses in October alone to pre-empt possible Trump tariffs of up to 15%, leaving this “economically trapped” metal tightening ex-US markets and inflating premiums. Prolonged disruptions at Grasberg, Kamoa-Kakula, El Teniente and Teck’s QB2, plus grade decline and slow ramp-ups at Collahuasi and Los Bronces, are constraining concentrate supply. BloombergNEF projects energy-transition demand could push copper into structural deficit from 2026, with a potential 19 Mt gap by 2050 without major new projects and recycling.

Technical Brief

- Benchmark Minerals’ Mackenzie classifies US-warehoused copper as “economically trapped”, leveraged against the CME forward curve rather than consumed.

- Grasberg (Indonesia), Kamoa-Kakula (DRC) and El Teniente (Chile) suffered year-long disruptions, with some not regaining 2024 output levels until 2027+.

- Even mines without stoppages are constrained by declining ore grades, more complex geology and slower-than-planned ramp-ups.

Our Take

BloombergNEF’s projection of a 19‑million‑tonne copper deficit by 2050, cited both here and in the 17 December structural‑deficit piece, effectively means that even Tier‑1 expansions at assets like Grasberg, Kamoa‑Kakula or El Teniente will not be enough without a wave of new greenfield approvals in Chile, Peru and the DRC.

The prospect of 15% US tariffs on copper and related metals puts additional strategic value on material already in CME‑deliverable US warehouses, as nearly 1 million tonnes parked domestically could become a buffer stock that reduces basis risk for traders and fabricators exposed to LME pricing.

With copper and lithium appearing together across many of the 817 Projects‑tagged pieces in our database, diversified majors such as BHP, Rio Tinto and Glencore are increasingly positioned to arbitrage capital between copper builds and battery‑metal projects as energy‑transition demand for both commodities accelerates into 2026–27.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.