Copper price and 1 Mt exchange stocks: key signals for mine planners

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

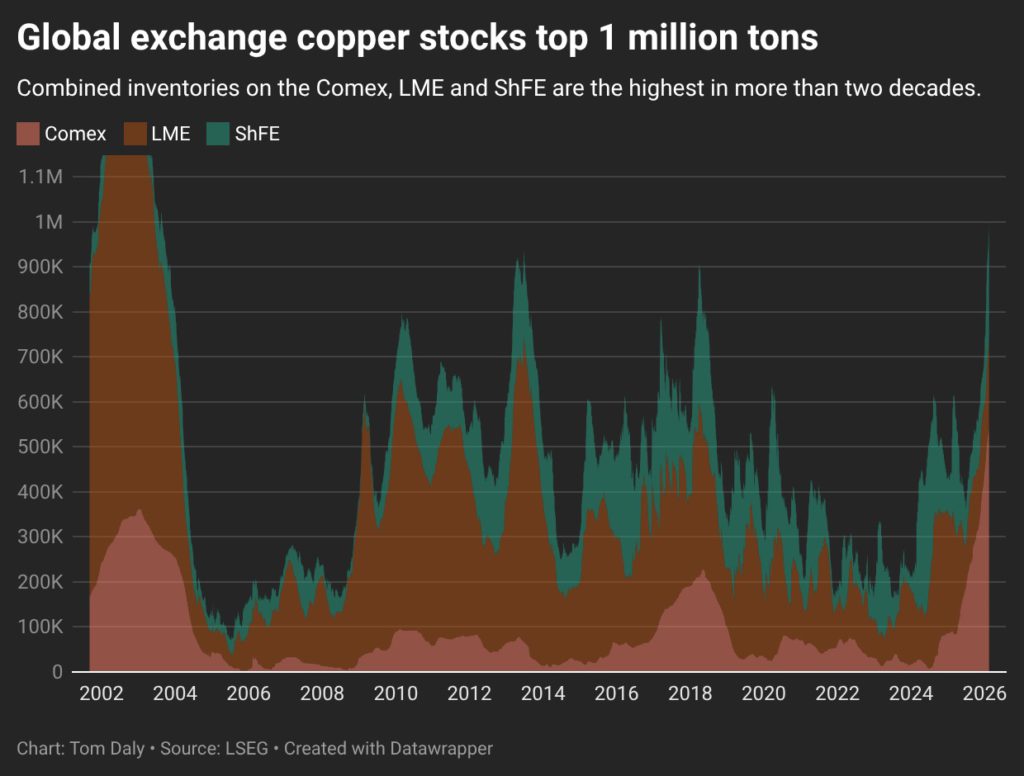

Copper exchange inventories on Comex, the LME and Shanghai Futures Exchange have climbed to 1.012 million tonnes, breaching the 1 million tonne mark for the first time since 2004 as tariff-driven stockpiling in the US combines with weak Chinese demand. In thin holiday trade, March copper in New York slipped nearly 1% to $5.76/lb ($12,700/t), around 12% below late-January highs after a more than 40% price gain through 2025. Satellite data also show January global smelter activity at its lowest level in nearly a decade of monitoring, signalling tighter refined output despite swollen visible stocks.

Technical Brief

- March copper futures in New York traded at $5.76/lb ($12,700/t) on Monday’s session.

- Price is currently 12% below late-January peak, after sharp pullbacks in early 2026 trading.

- Combined Comex, LME and ShFE visible copper stocks now total 1.012 million tonnes.

- This is the first time global exchange inventories have exceeded 1 Mt since 2004.

- LME and Shanghai Futures Exchange both recorded additional inflows on the preceding Friday, per Reuters.

- Tariff-driven US stockpiling has persisted for over a year, structurally altering regional physical availability.

- Satellite-based monitoring shows January smelter utilisation at the lowest level in nearly 10 years of records.

Our Take

BHP’s planned US$18 billion Vicuna copper investment in Argentina sits alongside its recent Xplor seed funding for early‑stage copper and gold explorers, signalling that BHP is hedging long‑dated supply risk with both tier‑one project build‑out and a broad exploration funnel rather than relying solely on brownfield expansions.

With combined exchange copper inventories now above 1.012 Mt while prices remain elevated, high‑capex projects like Vicuna in Argentina will likely be stress‑tested on cost curves and schedule, as any prolonged inventory overhang could narrow the window for sanctioning large new supply on bullish price assumptions.

Copper’s prominence in our database (502 keyword‑matched pieces, often paired with gold and silver) underscores that multi‑metal systems like Vicuna’s copper‑gold‑silver profile are increasingly central to majors’ portfolios, giving them optionality across three price cycles rather than pure copper exposure.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.