Chile’s 13 copper projects to 2026: capacity, risk and capex notes for engineers

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

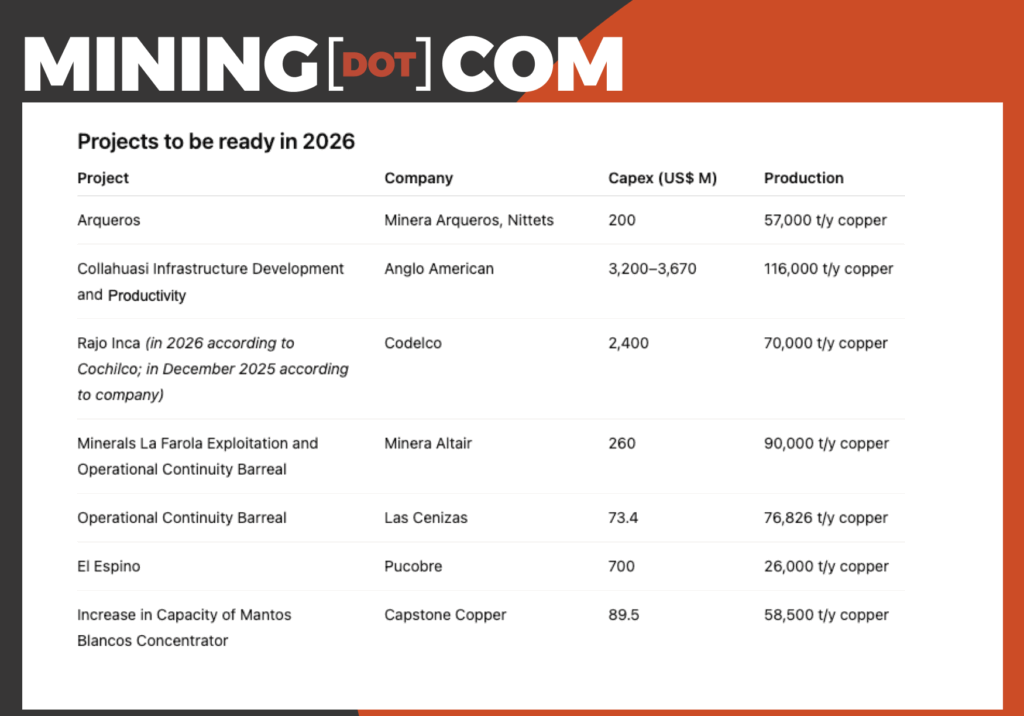

Thirteen Chilean copper projects worth $14.8 billion are targeting key 2026 milestones, with seven operations including Collahuasi’s C20+ life-extension, Codelco’s Rajo Inca and Capstone’s Mantos Blancos expected to add almost 500,000 tonnes/year of new capacity. A further six projects, such as BHP’s Spence and Capstone’s Santo Domingo, plan to start construction within a $7.7 billion pipeline that Cochilco says could lift national output to about 5.6 Mt, against a forecast 2026 deficit of 150,000–330,000 tonnes. José Antonio Kast’s incoming government is expected to streamline permitting and environmental approvals, but unresolved community opposition and potential legal challenges remain the main execution risk.

Technical Brief

- Collahuasi’s C20+ project centres on infrastructure and productivity upgrades to secure a 20‑year mine‑life extension.

- BHP’s Spence and Capstone’s Santo Domingo are slated to move from planning into physical construction during 2026.

- Cochilco’s $105 billion to 2034 pipeline includes brownfield expansions at consolidated assets such as Escondida.

- GEM’s Juan Ignacio Guzmán stresses 2026 start‑ups will not reach nameplate immediately, implying multi‑year ramp‑up curves.

- International Copper Study Group’s 2026 deficit estimate of 150,000 tonnes tightens further if Chilean projects slip.

- Community opposition is flagged as the dominant execution risk, with approvals for new builds still challengeable in court.

Our Take

Cochilco’s projected 5.6 Mt of Chilean copper output and $105 billion investment pipeline line up with our separate coverage of a structural copper deficit from 2026, signalling that projects like Collahuasi C20+, Rajo Inca and Santo Domingo will be competing into a seller’s market rather than fighting for offtake.

With Anglo American, BHP, Glencore and Codelco all embedded in these 13 Chilean projects, this cluster effectively overlaps with the same majors highlighted in the Anglo–Teck merger piece, reinforcing that long‑life Andean assets are becoming the core of global copper supply portfolios.

The emphasis on Chile in this article contrasts with our Argentina‑focused copper coverage, where several of the same players (BHP, Glencore) are still at an earlier exploration and permitting stage, suggesting Chile will likely capture near‑term tight‑market pricing while Argentina remains a longer‑dated option on the same porphyry belt.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

Construction

Quality control software for construction companies with material testing, batch tracking, and compliance management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.