AI boom and uranium demand in 2026: supply, price and project signals for miners

Reviewed by Tom Sullivan

First reported on MINING.com

30 Second Briefing

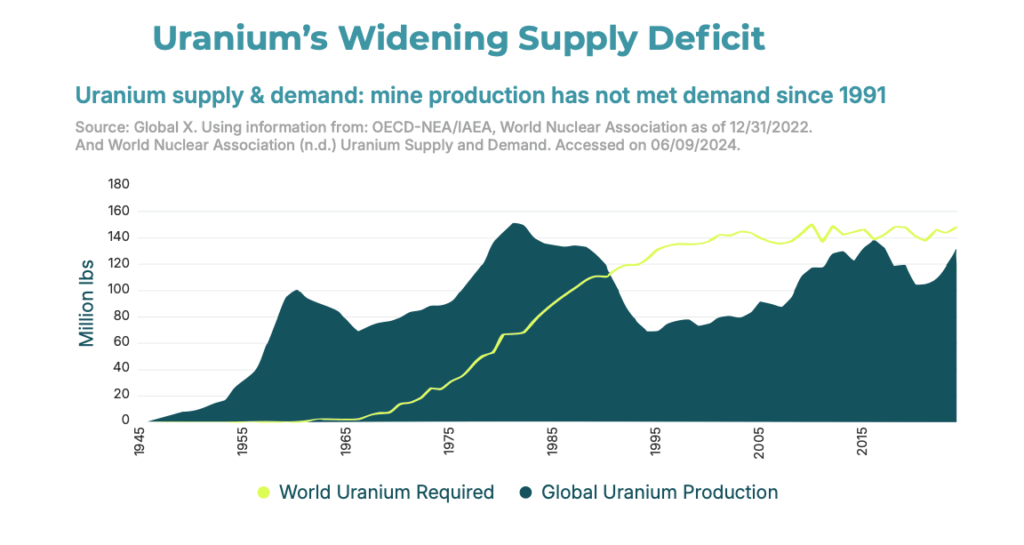

Artificial intelligence–driven power demand from hyperscale data centres is emerging as a structural load on grids, with a Uranium.io survey of 600+ investors showing over 63% expect AI consumption to become a material factor in nuclear planning within a decade. More than 85% of respondents see uranium prices rising into 2026, many citing a US$100–120/lb range and potential spikes to US$135/lb as mined supply is forecast to cover under 75% of future reactor needs. Sprott Asset Management expects a widening supply deficit, with higher long-term contract prices needed to restart idled mines and advance greenfield uranium projects.

Technical Brief

- Sprott Asset Management characterises uranium as a “two-speed” market: short-term volatility over bullish fundamentals.

- Utility term contracting is currently below replacement levels, increasing future catch-up procurement risk for fuel buyers.

- Long-term uranium contract prices are already drifting higher while spot prices remain comparatively contained.

- Sprott expects utilities’ ability to defer contracting to be time-limited, forcing a concentrated return to the market.

- Uranium.io survey respondents cite years of underinvestment, lengthy permitting and shrinking secondary supplies as key constraints.

Our Take

Uranium appears alongside copper, lithium and rare earths in our broader mining coverage, but only a subset of those 451 Mining stories explicitly link it to AI or data-centre power demand, suggesting this AI-driven demand thesis is still relatively new in mainstream project planning.

If more than three-quarters of future reactor requirements are expected to be unmet by mined uranium, North American and Asian utilities in countries like the US, Canada, China and South Korea are likely to lean harder on long-term contracting and inventory build, which tends to favour established producers over greenfield projects in the near term.

The 2026 price expectations in the US$100–120/lb range, with upside to US$135/lb if supply lags, would put many higher-cost or previously shelved uranium projects back into the money, but permitting and build timelines mean any new greenfield capacity will struggle to respond within the ‘next decade’ window investors are focused on.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.