2026 Winter Olympics medals: metals value and supply lens for mining teams

Reviewed by Joe Ashwell

First reported on MINING.com

30 Second Briefing

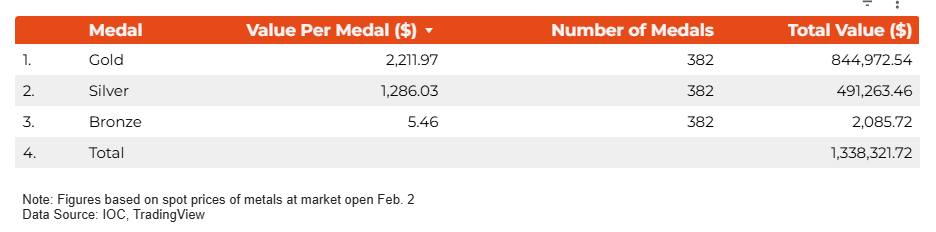

Metals price rallies have pushed the intrinsic value of the 1,146 medals to be awarded at Milano Cortina 2026 above $1.3 million, with each gold medal now worth about $2,212 in metal content versus roughly $736 at Beijing 2022. Design specifications show each gold medal contains about 500 g of .999 silver and 6 g of .9999 gold, silver medals contain the same 500 g of silver, and bronze medals use roughly 410 g of copper. Using current prices of ~$4,800/oz gold, $80/oz silver and $13,000/t copper, a silver medal is valued at ~$1,286 and a bronze at just $5.46.

Technical Brief

- Medal fabrication is by the Italian State Mint using recycled feedstock and renewable power.

- Milano Cortina 2026 medals adopt a split geometry symbolising dual host cities Milan and Cortina d’Ampezzo.

- Fine silver in gold and silver medals is specified at .999 purity; gold at .9999.

- Bronze medals are effectively high‑copper alloys, with c.410 g copper per unit dominating composition.

- Total output is 735 Olympic plus 411 Paralympic medals, giving 1,146 units manufactured.

- Design specifications are published by the International Olympic Committee, enabling precise metal mass and value calculations.

- Metals pricing context: current gold, silver and copper levels exceed all previous Winter Games benchmarks.

Our Take

The same gold and silver rally that has lifted the intrinsic value of Milano Cortina medals is also underpinning record valuations in the MINING.COM Top 50 rankings, where a recent piece noted gold edging towards $5,000/oz and record copper prices driving a $2 trillion combined market cap.

With silver now around $80/oz versus roughly $23/oz at Beijing 2022, the medal-value jump mirrors what our broader coverage has highlighted: silver-heavy producers such as Aya Gold & Silver and other precious-focused names have moved up recent Global Mining Power Rankings on the back of stronger price decks.

Copper’s role in the bronze medals aligns with multiple recent items in our database that flag copper as a key beneficiary of the current metals rally, suggesting that even symbolic uses like Olympic medals are being repriced in line with tight physical markets and bullish long-term demand expectations.

Prepared by collating external sources, AI-assisted tools, and Geomechanics.io’s proprietary mining database, then reviewed for technical accuracy & edited by our geotechnical team.

Related Articles

Related Industries & Products

Mining

Geotechnical software solutions for mining operations including CMRR analysis, hydrogeological testing, and data management.

CMRR-io

Streamline coal mine roof stability assessments with our cloud-based CMRR software featuring automated calculations, multi-scenario analysis, and collaborative workflows.

HYDROGEO-io

Comprehensive hydrogeological testing platform for managing, analysing, and reporting on packer tests, lugeon values, and hydraulic conductivity assessments.

GEODB-io

Centralised geotechnical data management solution for storing, accessing, and analysing all your site investigation and material testing data.